markeT insights report

Current State of Retail Customer Opportunities: Market Research Report 2025-2026 | United Kingdom

Queue Fatigue

is Real

58%

shoppers are looking for staff allocation in check-outs

Speed Trumps Shipping

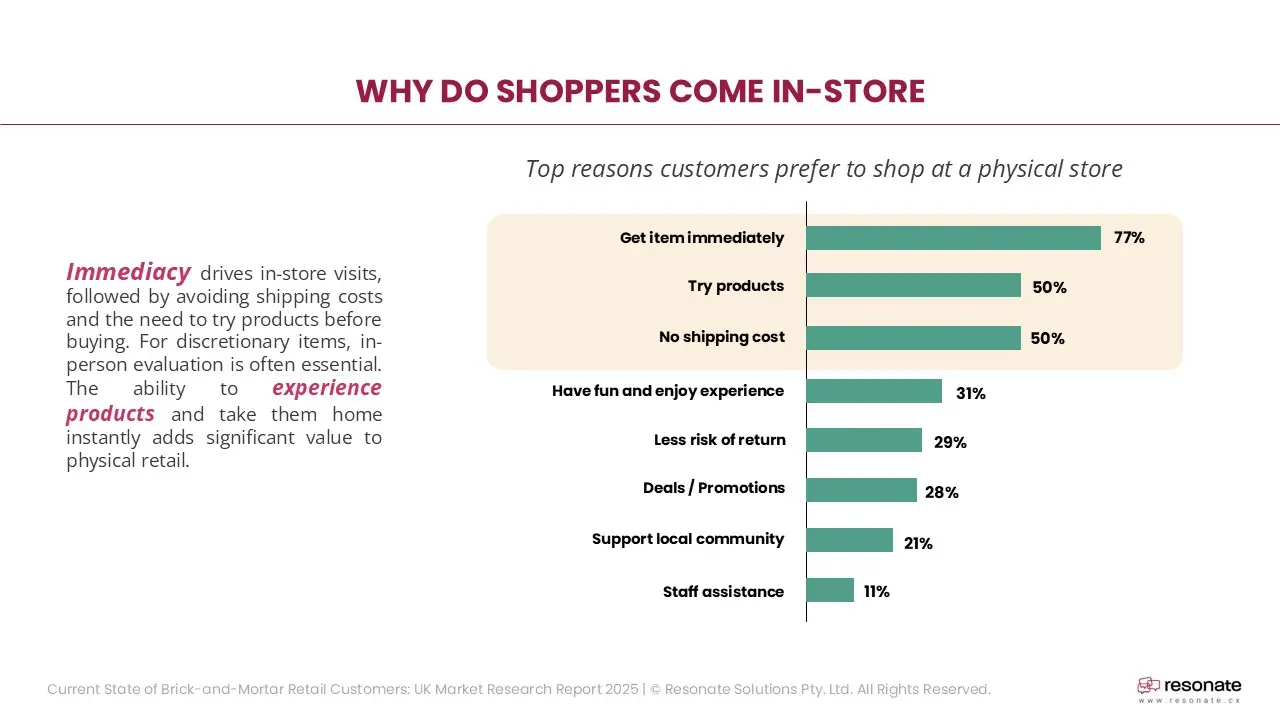

77%

shoppers prefer shopping in-store to get item immediately

Value Wins, Not Discounts

80%

NEO shoppers are willing to pay at least 5% extra for the dream experience

NEOs Drive the Impulse

8 out of 9

factors driving unplanned purchases come are led by NEOs.

Register for the Full Report

Uncovering Opportunities in the Retail Landscape

Resonate’s 4th Annual Retail Insight Report is here. As Australia’s leading Customer Experience platform and a trusted partner in the retail industry, Resonate delivers deep, data-driven perspectives on the evolving customer landscape.

Building on the success of our 2024 Brick-and-Mortar Report, this latest release uncovers the opportunities shaping the future of retail. From shifting customer expectations to market priorities, the report highlights the insights that matter most—helping retail leaders unlock growth, reduce churn, and strengthen customer loyalty.

Get the insights you need to stay ahead in a rapidly changing retail environment.

This exclusive insight report will cover:

Unlock exclusive benefits

Highlights you need to see

Don’t miss what retailers are raving about

Introduction

In the face of rising customer expectations, economic uncertainty, and growing pressure to deliver margin without sacrificing experience, UK retailers are standing at a pivotal crossroads. To stay ahead, they must not only know what their customers want—but why they want it, and how to deliver it better than anyone else.

This report reveals what UK shoppers told us about their in-store behaviours, frustrations, and drivers of loyalty. We unpack what makes them switch stores, what sparks unplanned purchases, and what ultimately turns one-time shoppers into long-term brand advocates.

From the deal-hunting Traditional to the high-value, high-expectation NEO consumer—this isn’t just another market overview. It’s your roadmap to unlocking growth, increasing conversion, and making experience the differentiator.

Top Pain Points Addressed in This Report

This report tackles the core challenges facing UK retailers today. From declining in-store footfall to squeezed margins and shifting shopper expectations, it offers clear, data-backed answers to some of the industry’s most pressing questions:

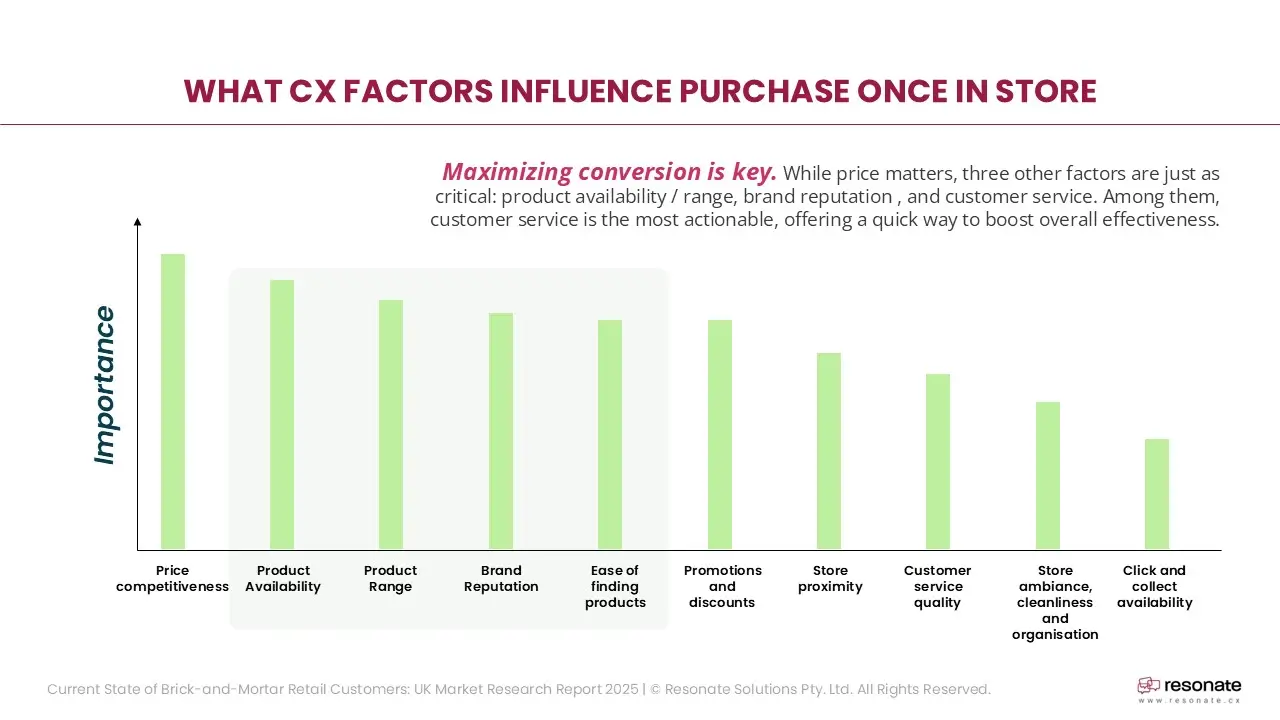

Where should we invest to get the best ROI on experience?

From staffing and layout to loyalty programs and tech upgrades, the report ranks what actually moves the needle on time spent, satisfaction, and spend.

How do we increase in-store basket size?

By revealing the triggers behind unplanned purchases—like product placement, emotion, and promotions—this report shows how to nudge spend without slashing prices.

What drives loyalty in a cost-conscious world?

With customer service ranking as the top loyalty driver, the report highlights where staff matter most and how experience—not discounts—wins repeat visits and advocacy.

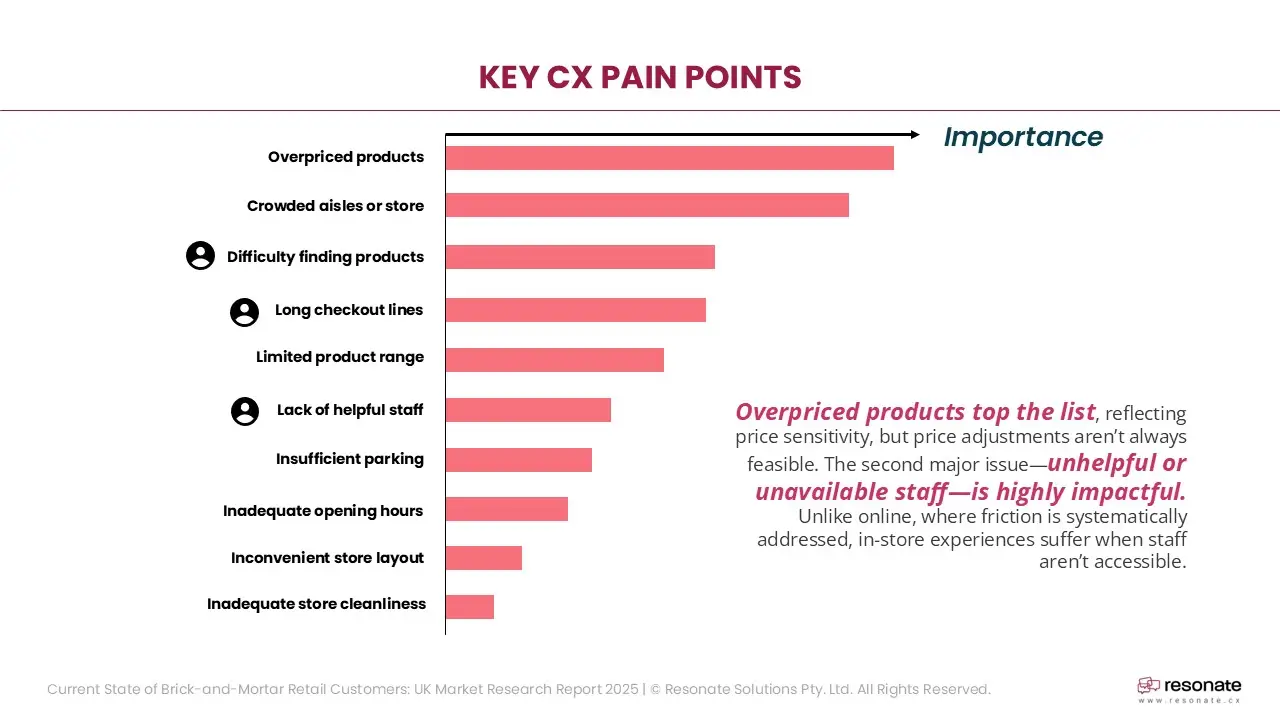

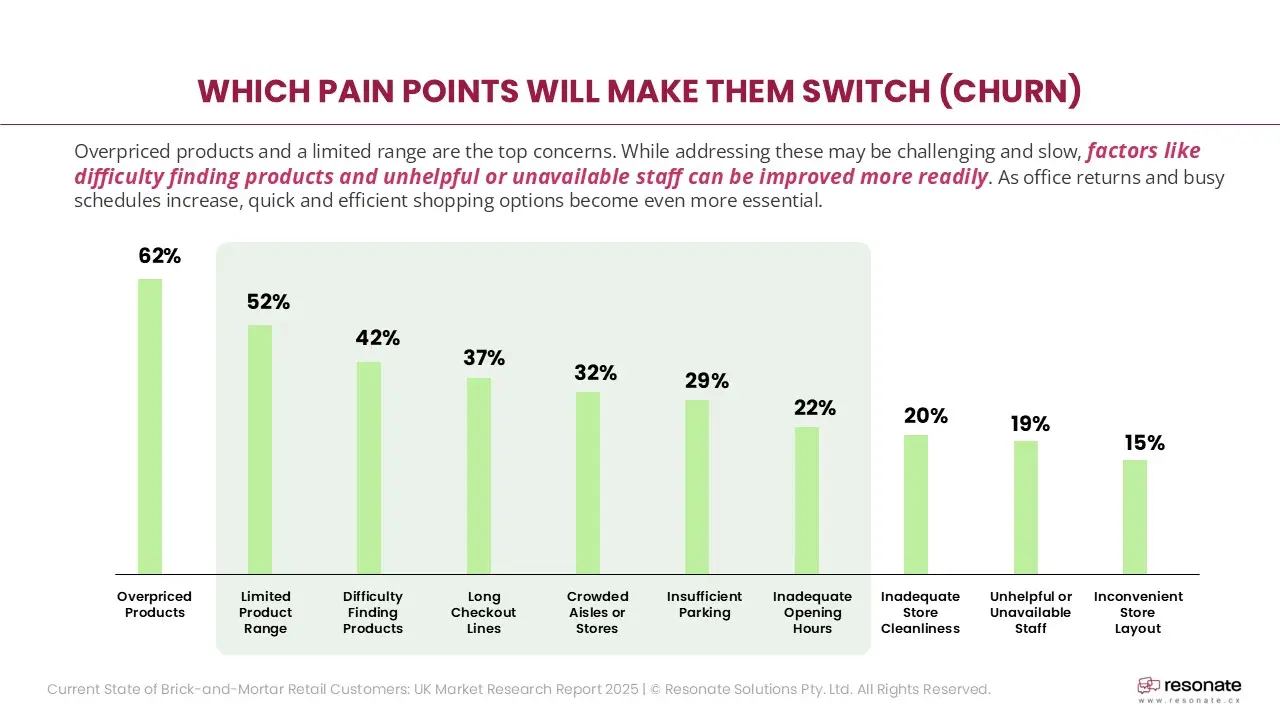

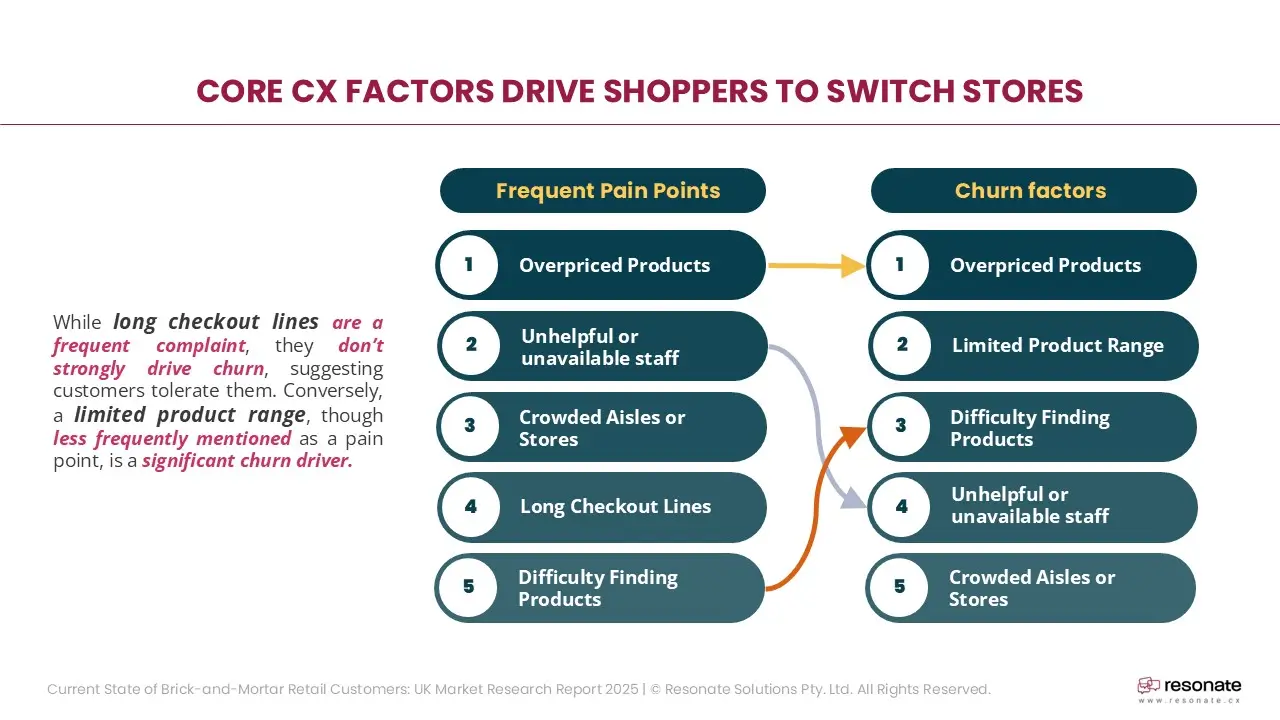

Why are customers walking out or switching brands?

It breaks down the key churn triggers (e.g. price perception, stock issues, unhelpful staff) and shows which are easiest to fix for fast results.

Understanding CX Drivers

Opportunity to Maximise

In-store CX & Revenue

Understanding Different Mindset

Leveraging In-Store Experiences

Driving Greater In-Store Revenue through

Dream Experiences

FAQs

Yes – 100% free. This report is available as a complimentary download, no strings attached. It’s our way of helping you stay ahead of evolving shopper behaviour and omnichannel trends in 2025. Just fill in your details and get instant access.

This report is designed for retail executives, marketing leaders, CX managers, and decision-makers who want to grow revenue through better omnichannel strategies. If you’re looking to increase basket size, drive footfall, boost checkouts, or future-proof your CX approach, this report is for you.

Very accurate. The findings are based on a statistically significant study of 900 UK consumers, conducted on January 2025. With a 95% confidence level and a margin of error of less than ±4%, you can trust the data to guide strategic decisions.

The report dives deep into omnichannel behaviour, from the evolving role of physical stores to digital-first decision-making, checkout preferences, loyalty drivers, and what customers expect from brands in 2025. It’s packed with insights to inform your retail and CX strategy.

Absolutely. We encourage you to share it with your wider team, from marketing and operations to customer experience and store teams. The more aligned your departments are, the better your execution across the omnichannel journey.

Yes – and we’d love to. If you’re looking to dive deeper into the findings or explore how they apply to your business, our team is happy to walk through the insights with you and your stakeholders. We can tailor the conversation to your goals and uncover practical opportunities for growth. Just fill out this page when you’re ready.

Experience the difference with Resonate CX

Speak to us and find out how we can help your business thrive.

Drive growth with our award-winning CXM platform

Related Resources

Report

Current State of Retail Customers 2025 Australia

Get first-hand insights on huge conversion opportunities in the Australian Retail Market. Leverage CX expertise, dominate the retail landscape, and maximise ROI with expert-level CX insights.

Report

Consumer Insights Report: What CX is Driving In-Store Conversion 2024

Leverage CX expertise, dominate the retail landscape, and maximise ROI with expert-level CX insights.

Report

The Current State of Brick-and-Mortar Retail Customers 2023

Gain valuable insights and an in-depth understanding of customer habits in relation to their shopping at physical retail stores.