Understanding your customers has never been more critical—or more complicated. In Australia, in particular, the cost of living is tightening purse strings, and the shopping landscape has become extremely saturated. In such a fiercely competitive environment, you’ll need to know exactly how and where to meet customers if you want your brand to succeed.

In early 2025, Resonate CX conducted a statistically significant study of consumers to uncover what’s really driving purchasing decisions today. Their findings provide a clear, data-backed view into contemporary customer shopping behaviour—how preferences are evolving, what matters most at the point of purchase, and how your brand can respond in real time.

This report, entitled Current State of Omni-Channel Retail: Consumer Research Report 2025 was presented to retail sector representatives by Resonate CX’s CEO and founder, Mita Bedi. It highlights key retail shopping CX trends among contemporary consumers across channels, personas, and purchase mindsets. The insights it offers can help you drive conversions and improve loyalty in an increasingly selective market.

In-Store vs. Online: Who’s Really Winning the Channel Battle?

It’s a common assumption that online retail has overtaken physical stores, driven by advances in technology and the growing demand for convenience, but the data tells a different story.

E-commerce has unquestionably grown in recent years, to the extent that many people assumed, over the COVID-19 pandemic, that in-store shopping might take a permanent back seat. That’s not what has ended up happening, however.

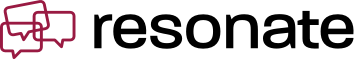

Three out of five Australian shoppers today (61%) still prefer shopping in-store for non-essential products, according to Resonate CX’s 2025 shopping behaviour research. In fact, when it comes to how often people shop weekly, in-store outpaces online by over 30%, specifically:

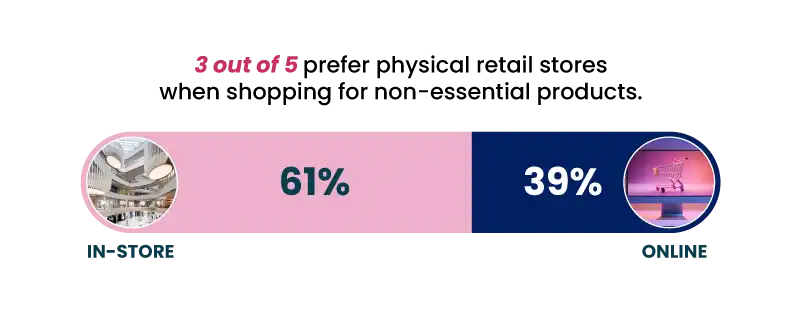

So, why hasn’t the digital takeover materialised? Many shoppers have a surprisingly simple answer: physical retail still delivers what online can’t. The immediacy, the tactile experience, the human touch—these are not just nostalgic benefits. They are experiences that drive strategic advantages that influence consumer shopping behaviour, especially in a climate where budgets are tighter, so getting it right the first time matters more than ever.

How Shopper Behaviour Is Changing: Key Shifts Over the Past Year

If you’ve felt like shoppers are thinking twice before they buy, you’re not imagining it. Nearly three in four Australians (74%) say they’ve changed their shopping behaviour in the past 12 months. And the reasons for these shifts reveal a consumer landscape that’s more selective, value-driven, and intentional than ever.

The top behavioural shifts revealed by our research include the following:

- Reduced non-essential spending – Discretionary purchases are being put on hold as shoppers refocus on necessities.

- More budget-conscious buying – Consumers are setting stricter price boundaries—and sticking to them.

- A move toward cheaper alternatives – Shoppers are trading down, especially when it comes to everyday or repeat purchases.

These shopping trends reflect a growing desire for control over spending, but they also reinforce the value of physical retail. Why? Because when people are cautious about what they buy, they want to see, feel, and compare. In-store environments give customers the chance to test quality firsthand and compare price-to-value in real time, which is much harder to do online.

Why In-Store Still Holds Power: The Unique Value of Physical Retail

Digital transactions might be convenient, but brick-and-mortar still promises irreplaceable advantages, especially as consumers become more cautious with their spending. Our study reveals exactly what keeps people coming back to physical stores:

In-store environments offer the hands-on reassurance many consumers need.

What Influences Shopping Channel Choice? Online vs. In-Store Decision Drivers

Today’s customers are weighing more than just price when they choose where to shop. The decision to buy in-store or online depends on the type of purchase, the stakes involved, and the convenience each channel offers.

Consumers typically prefer in-store shopping for:

- Returns and high value purchases – They want the reassurance that they can immediately and easily return unsatisfactory purchases. They also feel more confident buying more expensive items if they know assistance is readily available.

- Customer service and stock reliability – A knowledgeable staff member or visibly stocked shelves can turn hesitation into action.

On the other hand, online shopping dominates for:

- Convenience – Customers are more likely to turn to online when time is tight or when travelling to pick up the item at a physical store would be difficult.

- Price comparisons and bulk buying – Online platforms make it easier to scan and compare multiple options quickly.

Interestingly, promotions and payment options influence both channels equally. This shows that while discounts are appealing, they’re not enough to sway channel choice all by themselves.

The Role of Research and Information Seeking Before Purchase

Today’s shopper is highly informed—and if you’re not giving them the answers they want, they’ll move on. An overwhelming 97% of consumers conduct research before making a purchase. Most will be looking for multiple points of clarity before they click “buy” or head to the checkout counter.

This means that retailers are under pressure to deliver complete, easily digestible information in addition to an exemplary product. Moreover, customers also expect that information to be readily available across any and all channels they would think to access. They might make their final purchase in-store, but do their research and browsing online via the brand’s website, social media, or online reviews. Retailers thus need to make it as easy as possible for customers to learn as much as they can about products they’re thinking of buying, and help them move frictionlessly from one channel to the next.

Here’s what shoppers today prioritise:

Concern with stock availability, in particular, is at an all-time high due to a phenomenon that Resonate representatives term “the frazzle.” They argue that consumers readjusting to working onsite at least some of the time after being fully remote for multiple years find navigating public transport, traffic, and other logistical concerns more stressful than before. As a result, these customers need extra assurance that they won’t go to the trouble of visiting a store only to find the product they want out of stock.

What these findings tell you is that, in the modern customer’s eyes, transparency is a basic expectation, not just a perk. Everyone’s strapped for time these days, so when customers can’t immediately tell if a product is available or returnable, they’ll likely just stop the purchase altogether.

Understanding Unplanned Purchases: Why In-Store Converts More Impulses

Another of our most interesting and potentially productive findings is that impulse buying is thriving in-store. Our report shows that in-store shopping leads to twice as many unplanned purchases as online. Getting into the numbers, 23% of respondents to our survey stated that they often make unplanned purchases in-store, while only 12% said the same when online shopping. Meanwhile, 9% of respondents said they always make unplanned purchases in-store, and only 4% said they do so online.

Why does this matter? That’s because these impulse moments often drive margin-rich purchases—small extras, upgraded items, or things a customer didn’t know they needed until they saw them.

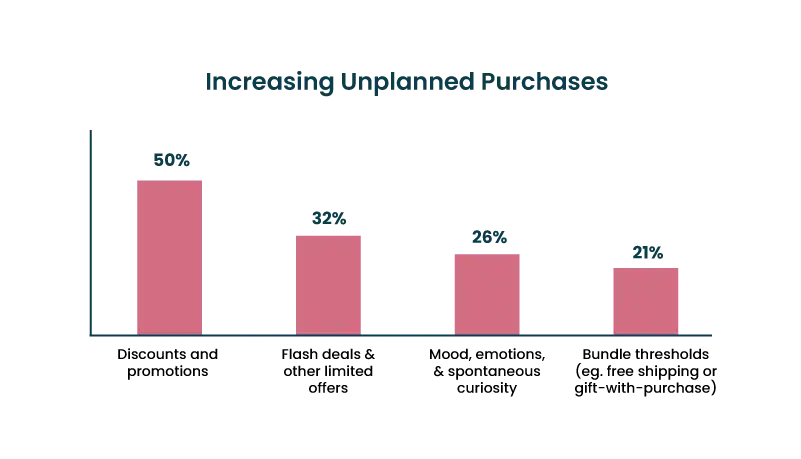

The top triggers for unplanned buying include:

Of these factors, many Australian retailers have yet to fully maximise the surprisingly significant influence that mood and emotions have on impulse purchasing behaviour. This study suggests that they’d be wise to do so. When staff members at stores take very deliberate action to lift customers’ mood, customers generally will, in turn, feel more motivated to spend more time browsing and may even voluntarily increase their basket size.

What’s striking is that many of these drivers are deeply human. Eye-catching displays, sensory cues, and the psychology of “just in case” all come into play. Shoppers are surrounded by stimuli in-store—endcaps, music, staff suggestions—that subtly encourage them to explore. Online, these cues are often flatter and easier to scroll past.

Smarter Omni-Channel Strategies: Aligning Experiences Across Touchpoints

Of course, the point of all this research isn’t to encourage retailers to put all their eggs in one basket, but to make the case for a strong omni-channel approach to retail. Your customers won’t just be toggling between online and offline, after all. They expect a cohesive experience across all channels, personalised to how they shop.

Making this work requires you to understand not only the channels your customers use but also how their preferences and mindsets shape their shopping decisions. If you segment customers based on these behaviours, you can create personalised experiences that meet them where they are—whether online, in-store, or both.

Resonate CX’s mindset segmentation reveals three key shopper personas:

35%

Planners

Cautious, price-sensitive, and focused on value. They do their homework and rarely deviate from their list.

44%

Conditional Growers

Open to spending more if the experience meets their expectations.

21%

Basket Boosters

Impulse-prone, convenience-focused, and motivated by seamless, premium service.

Each type of buyer responds to different touchpoints in their own way. For example:

Planners

Conditional Growers

Basket Boosters

Unified loyalty programs, real-time transparency on your stock levels, and consistent messaging across touchpoints help close the purchasing loop. Personalised promotions, especially those tied to mindset behaviour, outperform generic blanket discounts every time.

Conclusion: How Retailers Can Win in 2025

If one thing is clear from our 2025 study, it’s this: you’re competing based on the quality of the whole purchasing experience, not just that of your product. While price, stock availability, and convenience remain front-of-mind for many shoppers, emotional drivers like trust, store atmosphere both on- and offline, and smooth interactions are what tip the scales.

To thrive in this new landscape, retailers need to strike the right balance:

- Optimise for convenience, but don’t sacrifice experience. Make it easy to buy, easy to return, and easy to switch between channels without friction.

- Respect mindset differences. What motivates a Planner will frustrate a Basket Booster. A one-size-fits-all approach no longer fits anyone.

- Make omnichannel strategic, not scattered. Show up where it matters. That might mean surfacing accurate stock online, offering click-and-collect with real follow-through, or creating in-store moments that drive discovery and delight.

- Turn insight into action. It’s not enough to know what customers want—you need to act on it, quickly and with precision.

Platforms like Resonate CX are purpose-built to help retailers weather the challenges of contemporary markets and come out thriving. You can gather intelligence on real-time shopper behaviours across both online and in-store touchpoints, which in turn can help you identify exactly where customers are dropping off or making impulsive buys. Our AI-driven insights ensure you’re always one step ahead and well-positioned to optimise everything from product placement to personalised offers. We turn complex data into clear, actionable strategies—and, in the process, empower brands to create a seamless shopping experience across every channel.

In 2025, the winners won’t be those with the loudest promotions or the widest product range. They’ll be the retailers who listen, who adapt, and who make shopping feel both frictionless and human for every customer.