TLDR:

- Parents are segmented into Explorers, Balancers, and Partners, each with different churn risks and priorities when choosing nurseries.

- High churn remains a major issue: Many families are switching nursery providers due to concerns over safety, staff quality, and poor communication—areas providers can address proactively.

- Curriculum expectations are high; parents expect programs that prepare their children for school and development milestones.

- Price increases alone rarely drive churn, but if not matched with value improvements, they can trigger switching.

- Understanding which parent segment you serve allows targeted retention strategies rather than a one-size-fits-all approach.

Most families don’t leave a nursery in a dramatic exit. There’s no big speech. No confrontation.

Instead, it starts with a feeling. A hesitation. A pause when re-enrolling. And then, quietly, they don’t come back.

This is the reality of churn in the UK nursery sector today. And as the market grows more competitive, understanding why families drift is critical.

At Resonate CX, we’ve researched what drives parents to switch nursery providers. Our research surfaced one key insight: families don’t all churn for the same reason, but the patterns are predictable.

To understand the risk, you have to understand the people.

Some families use nursery because they have to. Others because they want to. Some prioritise flexibility. Others want structure and progress updates. When that core need isn’t met, or worse, isn’t recognised, the risk of leaving quietly increases.

Our insights report, Current Landscape of the UK Nursery: Market Research Report 2025 reveals that parents don’t all behave the same way. In fact, they fall into three distinct groups. Each with their own values, triggers, and tipping points.

If you want to keep families from drifting, you have to understand what keeps each of them anchored.

Nurseries Customer Opportunities 2025 | United Kingdom

Uncover what parents value most when choosing childcare providers.

I. Meet the Key Parent Segments

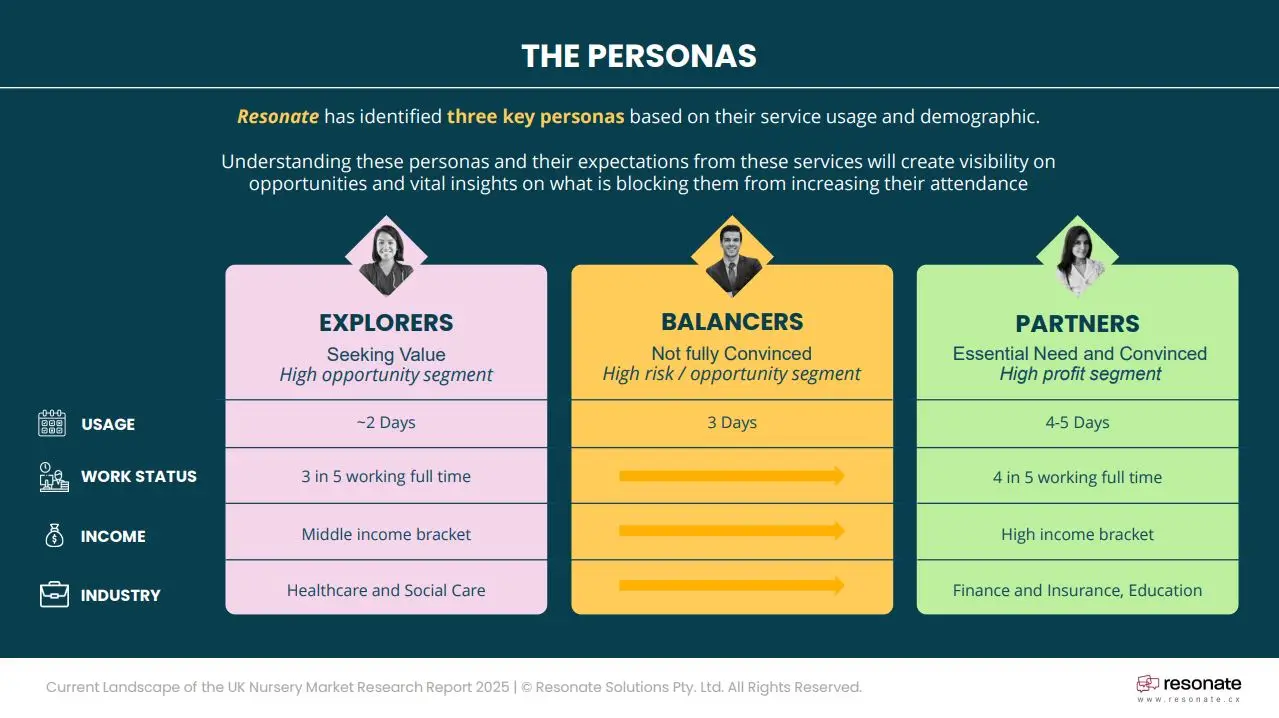

Based on analysis of usage patterns, demographics, and service expectations, Resonate CX has identified three distinct parent personas that influence nursery churn outcomes: Explorers, Balancers, and Partners. Each comes with unique priorities and risk levels, and providers need to understand those differences to create a more responsive customer experience strategy.

1. Explorers

Explorers are the most flexible but also the most volatile user group. They typically use nursery services 1 to 2 days a week and often have access to alternative care options. Their defining characteristics are:

- Medium-income households

- Often employed in healthcare or social care

- Mostly full-time working parents

- Motivated by social interaction and flexible arrangements

- Less committed to long-term enrolment or structured curricula

This group has a higher-than-average churn rate, so it tends to be more price-sensitive and open to switching, especially when faced with financial strain or more convenient options.

2. Balancers

Balancers are primarily concerned with managing affordability while meeting their family’s practical needs. They enrol their children around 3 days per week and are especially affected by employer flexibility and scheduling. These qualities tend to define them:

- Broad income spread, with many in the middle-income bracket

- Work across various sectors, often balancing full-time and part-time work within the household

- Motivated by cost-effectiveness and maintaining routine

- Sensitive to value perception and service reliability

Balancers are considered a medium churn risk—more loyal than Explorers, but still responsive to pricing changes and service quality.

3. Partners

Partners are the most invested in the service and use it most frequently, with 4 to 5 enrolled days per week. They value stability, structure, and developmental outcomes. They’re typically characterised as follows:

- Higher-income households

- Predominantly in education, finance, or other professional fields

- Dual full-time earners are common

- Motivated by academic development and premium quality of care

- Expect strong communication, staff qualifications, and consistency

Although Partners show lower churn rates overall, their expectations are high. If providers fail to meet these, Partners are willing to switch to competitors offering a better match.

II. How Usage Patterns Differ by Segment

The number of days a child is enrolled in nursery each week often correlates with a family’s level of commitment to the service—and, by extension, their likelihood to churn. Families using fewer days tend to view nursery as a flexible or supplementary service, while those with higher usage typically treat it as essential to their daily routine.

Here’s how enrolment patterns break down by parent segment:

- Explorers: 1–2 days per week

- Balancers: 3 days per week

- Partners: 4–5 days per week

Based on these usage patterns, what does churn look like before it happens? Churn isn’t always about loud dissatisfaction. Sometimes it’s just a slow fade:

- The parent who used to ask questions has gone quiet.

- The child whose schedule was full-time is now part-time.

- The emails stop getting opened.

But the signs are there and they often match usage patterns.

Explorers attend least (1–2 days/week), Partners the most (4–5 days), with Balancers in between. The less they use, the more likely they are to leave unless they feel anchored. To understand how to prevent churn, it is important we understand why each segment first chose these services.

III. Why Each Segment Chooses Nursery and Wraparound Care

According to Resonate CX’s research, the top motivations for using nursery or wraparound care include:

- Supporting work schedules

- Providing social interaction

- Supporting education and child development

- Maintaining a predictable family routine

- Addressing a lack of other care options

Let’s look at how these motivations show up differently by segment:

- Explorers often enrol to support social development and create routine, but they place less emphasis on structured learning. Work may be a reason, but not the sole driver. Their interest tends to wane if the service doesn’t align with their flexible expectations.

- Balancers are more practically motivated. Nursery services help them manage work-life demands, and they expect reasonable costs and competent care. If a provider fails to deliver consistent value, or if employer support shifts, Balancers are likely to reassess.

- Partners treat nursery as a core part of their child’s early development. Academic preparation, skilled educators, and regular progress updates are non-negotiables. These parents are more loyal, but also more discerning, especially when it comes to communication and staff quality.

These distinctions matter because they shape how each group defines “value.” And when customers have a reason to question value, churn becomes more likely.

While everyone technically uses the same service, their why is different. And when that why is no longer fulfilled, churn becomes inevitable.Families may all use the same services, but the motivations behind that choice vary considerably between segments. These reasons often offer early clues into loyalty levels and churn risk.

Churn rarely shows up as an angry email. It’s more like a fading presence.

A parent who used to chat about their child’s day now keeps the conversation short. A family that used to engage with surveys or feedback forms stops responding. Enrolment days drop, one at a time. As a leader not on the ground , how do you know when things are going well or not at each centre? Check how an Education CXM can help you.

IV. The Barriers That Trigger Switching

Families don’t switch providers without reason. While some external factors, like job loss or relocation, are beyond a provider’s control, many churn triggers are internal and preventable.

The most effective interventions begin with understanding which barriers matter most to each parent segment. Let’s look into the most common churn triggers for each group now:

Explorers

- Readiness to cut costs: Explorers may not necessarily consider the service a non-negotiable investment. Many are quick to leave in the event of sudden job loss or financial problems.

- Alternative care options: If a friend, relative, or community scheme becomes available, nursery use may drop or disappear altogether.

- Limited emphasis on structured learning: Explorers are more likely to prioritise social interaction and play over formal curricula, which can make educational programmes feel less essential.

Balancers

- Affordability concerns: This group is particularly responsive to subsidy changes or perceived shifts in value for money.

- Need for experienced staff: While qualifications matter, Balancers also look for warmth and real-world experience. A lack of trust in staff can be a deal-breaker.

- Employer flexibility: When work patterns shift, so do their care needs. Providers unable to support changing schedules may lose these families.

Partners

- High expectations around quality: This includes everything from curriculum design to staff communication and physical facilities.

- Communication gaps: Even minor issues can escalate if parents feel out of the loop, particularly when their child spends most of the week in care.

- Curriculum or developmental misalignment: If progress isn’t clear or programming feels too generalised, Partners may seek alternatives that better reflect their child’s needs.

Some of these challenges, like job-related instability, are hard to predict or solve. But others, like clearer communication, more visible staff experience, or regular updates on curriculum goals, are within a provider’s control and offer meaningful opportunities to reduce churn.

V. Churn Rates and Main Reasons for Switching Providers

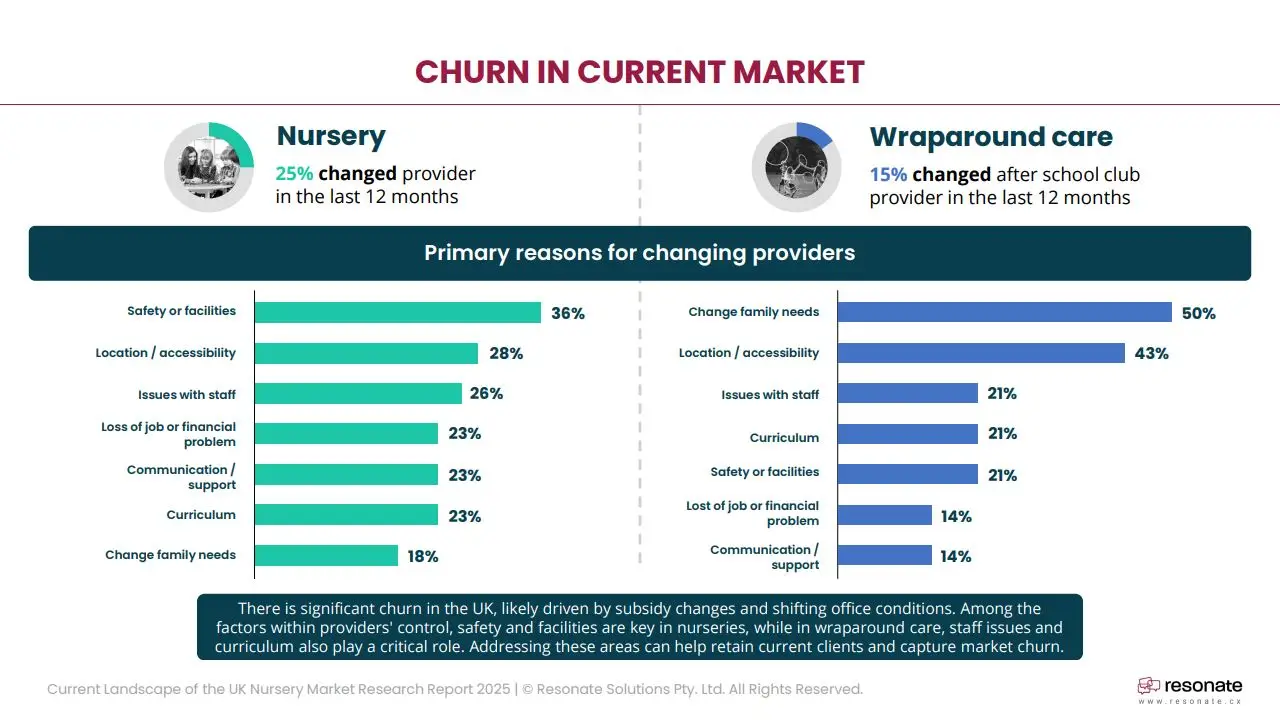

One in four families has changed nursery providers in the past 12 months. The risk is real, and so are the reasons.

Churn percentages by segment:

- Explorers: Highest churn risk, especially for nursery services (27%)

- Balancers: Medium churn risk, with 25% report switching nurseries, while wraparound care churn is slightly lower

- Partners: Moderate churn risk of 25%; though more stable overall, they will switch if core expectations aren’t met

Top reasons for switching (across all segments):

- Safety and facilities (e.g., inadequate infrastructure, poor hygiene)

- Location and accessibility (e.g., harder commutes, inconvenient drop-off points)

- Staff-related issues (e.g., lack of trust, poor communication, underqualification)

- Financial or employment changes

- Poor communication

- Curriculum misalignment

Safety and staff quality stand out as dominant themes for nurseries. In wraparound care, families are especially sensitive to staff engagement and curriculum alignment—likely because they expect older children to be engaged meaningfully, not just supervised.

Providers that actively monitor these friction points—and act quickly when signals arise—are better positioned to keep families from walking away.

VI. How to Reduce Churn: Strategies for Each Persona

Reducing churn starts with alignment. When a provider understands what each segment values and where their frustrations lie, it becomes easier to deliver experiences that retain families rather than lose them.

For Explorers

- Offer flexible attendance options without pressure to commit long term.

- Communicate the benefits of even limited attendance, especially for social development.

- Build trust through consistent, approachable updates that feel relevant but not overwhelming.

For Balancers

- Make affordability visible by clearly communicating what’s included and where value is delivered.

- Spotlight the experience and warmth of your educators, not just their qualifications.

- Support shifting work schedules with adaptable care windows or clear cancellation policies.

For Partners

- Prioritise structured programming and evidence of developmental progress.

- Maintain frequent, proactive communication, especially around curriculum and staff changes.

- Treat these families as collaborators; offer feedback loops, planning sessions, and meaningful updates.

Churn prevention isn’t about one-size-fits-all loyalty programmes or price cuts. It’s about relevance. When families see themselves reflected in your service design and communication style, they’re far more likely to stay.

VII. Conclusion

When families leave, it’s rarely on a whim. There’s always a reason, and it’s often been building for weeks or months.

Each parent segment has its own tipping point, so it’s always a good idea to tune into what motivates Explorers, Balancers, and Partners and address their specific barriers. Providers that apply this kind of targeted approach can turn churn risk into a powerful growth opportunity.