TLDR:

- Mindset‑driven segments outshine demographics: Australian shoppers in 2025 aren’t defined by age or income, but by their mindset—why they shop matters more than who they are.

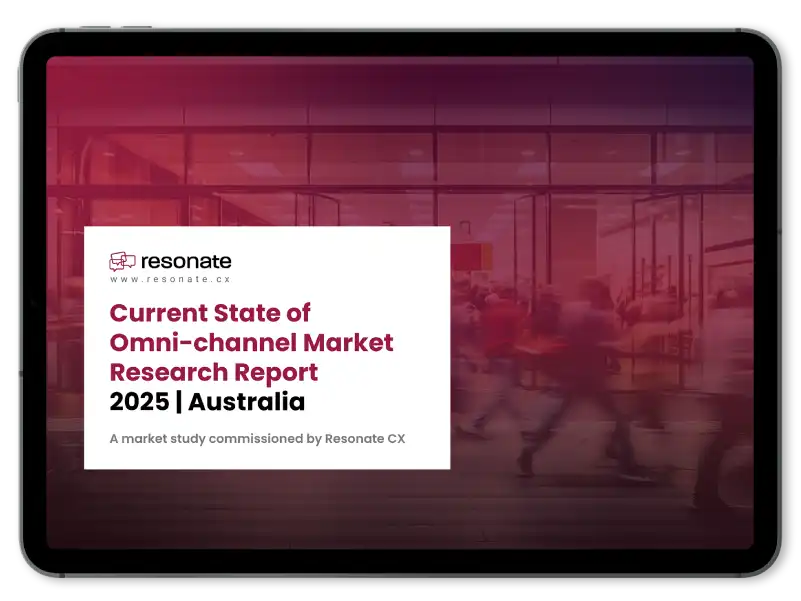

- Three key personas dominate: Planners (35%), Basket Boosters (21%), and Conditional Growers (44%) are distinct mindsets that guide retail growth strategies.

- Mindsets > demographics: These segments exhibit different behaviors even when income or age overlaps, so tailoring experiences by mindset unlocks better loyalty and conversion.

- Premium experience pays off: Basket Boosters and Conditional Growers are willing to pay more for hassle‑free returns, secure payments, loyalty perks, and convenience.

- Strategic focus: Retail growth in 2025 depends on designing experiences that respect mindsets—providing clarity, trust, convenience, and small delights outweigh chasing discounts.

It’s a bright summer Saturday in Sydney. The kind of day where shopping isn’t just about running an errand to go grocery shopping and get the essentials but about discovery, delight, and, for some, retail therapy.

At Chatswood, three friends step inside the mall: Liv, Max, and Cassie. They’re headed for the same shops, but their reasons for being there couldn’t be more different. And without knowing it, they’re about to embody one of the most important retail insights of 2025: mindset matters more than ever.

According to Resonate CX’s 2025 Omni-Channel Retail Consumer Report, Australian shoppers no longer fit into neat boxes based on age or income. Instead, they fall into mindset-driven segments that reveal not just who they are, but why they buy. And it turns out that understanding these mindsets — Planner, Basket Booster, and Conditional Grower — is the key to unlocking long-term growth in a crowded market.

According to Resonate CX’s Current State of Omni-Channel Retail Consumer Research Report 2025 ANZ, Australian shoppers are no longer simply motivated by price. Rather, they fall into different personas with distinct attitudes, expectations, and motives.

The report reveals three distinct shopper personas that retailers can’t afford to ignore: Planners, Basket Boosters, and Conditional Growers. Each of these retail customer segments has its own shopping style, spending habits, and dream experiences.

Retail market insight report 2025 | australia

From online to in-store, understand how to capture and keep customers.

Meet the Three Retail Mindsets: Planners, Conditional Growers, and Basket Boosters

1. The Planner (35% market share)

Liv is a Planner through and through. She walks in with a mental list, digital coupons queued, and a strict budget in mind. She’s older, practical, and driven by value. Price and promotions matter most. A slow delivery? She’ll find it tolerable, but only if it’s free!

Retailers often overlook shoppers like Liv because she’s unlikely to splurge. But with Planners making up 35% of the market, winning their loyalty through clarity, consistency, and trust can deliver steady returns. For Liv, it’s about reliability. Meet her expectations, and she’ll be back next weekend. Disappoint her, and she’s gone.

2. The Basket Booster (21% market share)

Max is the opposite. No list. No budget. Just vibes. You can say he’s just happy to be there to go shopping with his friends. He strolls into a store, sees a pop-up offer on his phone, and suddenly he’s walking out with triple the items he planned to buy. He’s a classic Basket Booster. Young, urban, and willing to pay a premium for a frictionless experience.

He doesn’t tolerate delays. Four days for delivery? He’ll switch to in-store. Confusing return policy? Forget it. But get things right like fast checkout, one-tap payment, clean UX, and Max is your dream customer. Though they only make up 21% of shoppers, Basket Boosters are worth their weight in margin.

3. The Conditional Growers (44% market share)

Then there’s Tori. She’s a Conditional Grower, somewhere in the middle. She likes a good deal, but also wants a bit of magic. She doesn’t need the flash, but she will spend more if the experience is worth it. Click-and-collect for her is a big win. But personalised loyalty perks? Even better! She won’t impulse-buy like Max, but treat her right and her basket grows over time.

Conditional Growers make up the biggest chunk of the market at 44%. They’re the steady, scalable opportunity most brands miss while chasing extremes.

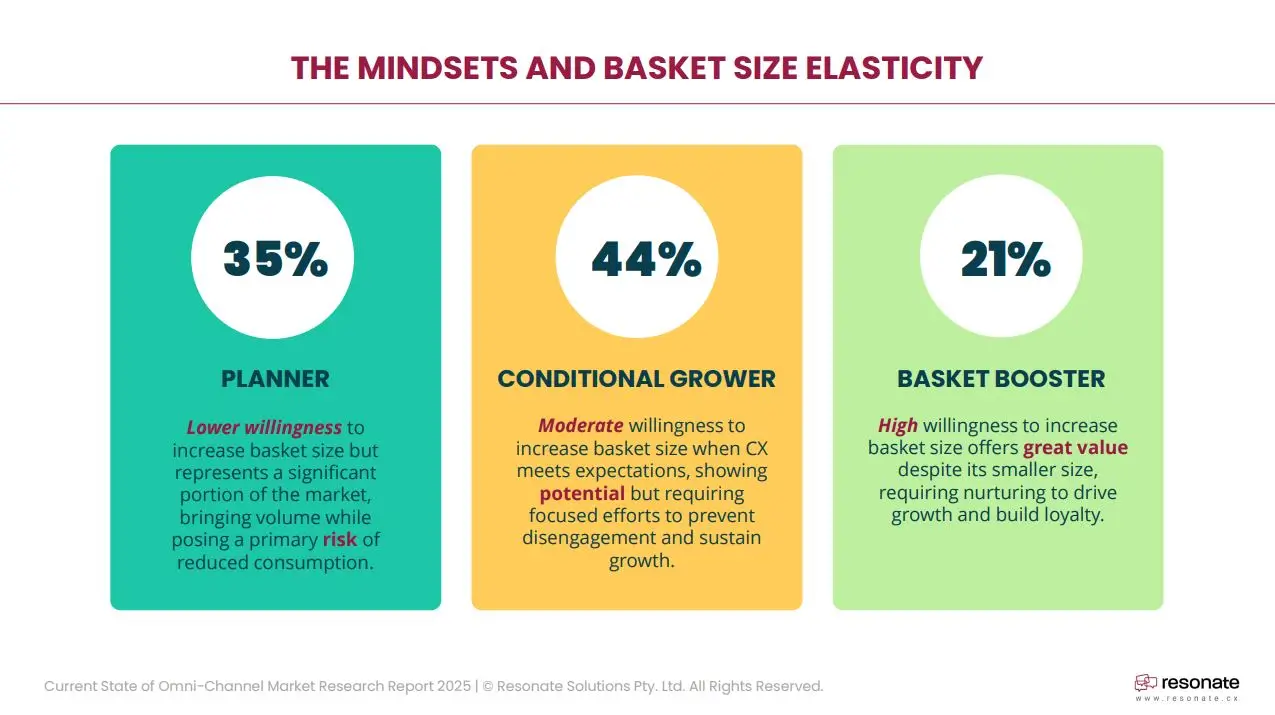

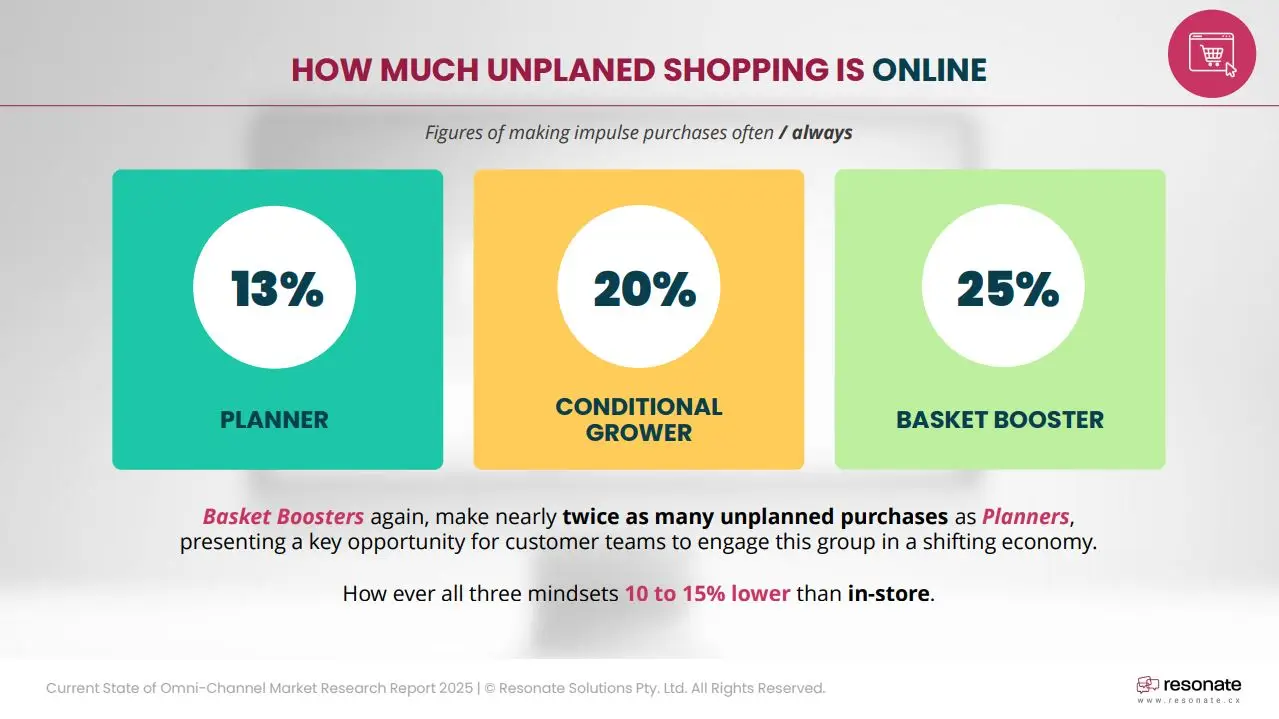

Knowing these consumer personas in retail helps businesses identify which strategies create value for each mindset. A deep understanding of how mindset affects shopping choices and impulse buying patterns can be especially valuable to retailers that want to encourage loyalty and sustained growth

Why Mindsets > Demographics

The beauty of mindset segmentation is that it explains why people act the way they do and not just what they earn or how old they are. Max and Cassie might have similar incomes, but entirely different expectations. Liv and Cassie both value price, but only one responds to loyalty perks.

When retailers tailor experiences based on mindset, they unlock smarter ways to drive loyalty, conversion, and bigger baskets without needing to chase endless discounts.

Designing the Dream Retail Experience: What Shoppers Really Want

When it comes to in-store experiences, all three shopper mindsets—Planners, Basket Boosters, and Conditional Growers—share similar priorities, but they rank them differently. Planners are primarily value-driven, focusing on price and promotions. Basket Boosters, by contrast, prioritise convenience, fast delivery, and hassle-free returns. Conditional Growers fall somewhere in between but place the highest importance on convenience features like click-and-collect and easy return options.

Despite their differences, these mindsets have strong commonalities that help define the ideal retail experience and reveal what shoppers want in 2025.

Online, the top “dream feature” across all shopper types is secure payment options, mentioned by 41% of respondents. This is followed by:

- Easy return processes – 33%

- Simple, intuitive navigation – 31%

- Prominent discounts and deals – 30%)

- Fast checkout – 29%

- Detailed product descriptions and images – 26%

- Reliable product reviews – 25%

Interestingly, while discounts are important, they ranked below payment security and returns. This suggests that trust, ease, and functionality are taking precedence over price alone.

In-store, shopper expectations shift. The top two features—both mentioned by 40% of respondents—are:

- Convenient opening hours

- More frequent or attractive promotions

These are followed by:

- Greater product variety – 37%

- Enhanced loyalty programmes- 36%

- Free parking – 24%

- Friendlier staff – 22%

- Better staff expertise – 22%

The demand for extended or more flexible opening hours highlights a potential mismatch between current retail schedules and shoppers’ actual availability.

Together, these insights offer a roadmap for designing the ideal retail experience where convenience, trust, and flexibility matter just as much as pricing.

Willingness to Pay More: How Better Experiences Justify Premium Pricing

Basket Boosters and Conditional Growers are noticeably more willing to pay extra for what they perceive as an ideal retail experience. Broader trends identified throughout the report confirm that these segments are open to premium pricing when expectations are exceeded.

So what are shoppers willing to pay more for?

- Hassle-free returns – Shoppers expect no added cost, no repackaging, and quick refunds. This is especially true for high-value mindsets that associate return simplicity with brand trust. (

- Secure transactions – Digital confidence matters. Customers are more likely to pay slightly more when transactions feel safe and frictionless.

- Loyalty program benefits – Programs that are transparent, personalised, and easy to redeem drive added engagement. Boosters in particular respond well to exclusive perks and experiences.

- Convenience and speed – Fast checkouts, low-effort navigation, real-time delivery updates are increasingly non-negotiable for experience-driven shoppers.

Collectively, this reveals that discounts alone cannot build sustainable growth. Retailers who invest in delivering clear, consistent, and convenient experiences are more likely to build trust, drive loyalty, and increase revenue even in today’s cost-sensitive climate. Instead of racing to the bottom on price, the opportunity lies in creating moments of delight that justify customer experience premium pricing. Simply put, shoppers pay more for CX when it reflects care, clarity, and convenience.

Conclusion: Winning in 2025 by Aligning with Shopper Mindsets

By the end of the day, Liv leaves satisfied with her smart buys. Max is carrying three bags and already thinking about next weekend. Cassie checks her loyalty points on the app, smiling at a “thanks for shopping” message.

Three shoppers. One store. Completely different expectations, all met by smart retail design.

The retailers who win in 2025 are decoding mindset, designing for nuance, and delivering the kind of experience that makes every shopper feel like the brand gets them.

So here’s the real question: is your retail strategy ready to pass the Saturday test?