TLDR:

- The decision-making process for childcare has become more complex for modern families due to post-pandemic realities, hybrid work models, rising costs, and evolving expectations. These factors necessitate a deeper understanding of parental priorities beyond traditional considerations.

- There’s a noticeable shift from full-time to part-time childcare, with only 22% of families now choosing full-time nursery services compared to 30% in the previous year. This trend is driven by increasing financial pressures, a desire for better family balance, and new work-life rhythms adopted by parents.

- Families choose nurseries primarily for work-related commitments, to foster social interaction among children, and to provide early education opportunities. These motivations highlight the multifaceted role nurseries play in supporting both parental careers and child development.

- In contrast, wraparound care is predominantly sought to support existing family routines and offer logistical ease for parents. This type of care helps bridge gaps in childcare outside of traditional school hours, ensuring seamless transitions for children and convenience for families.

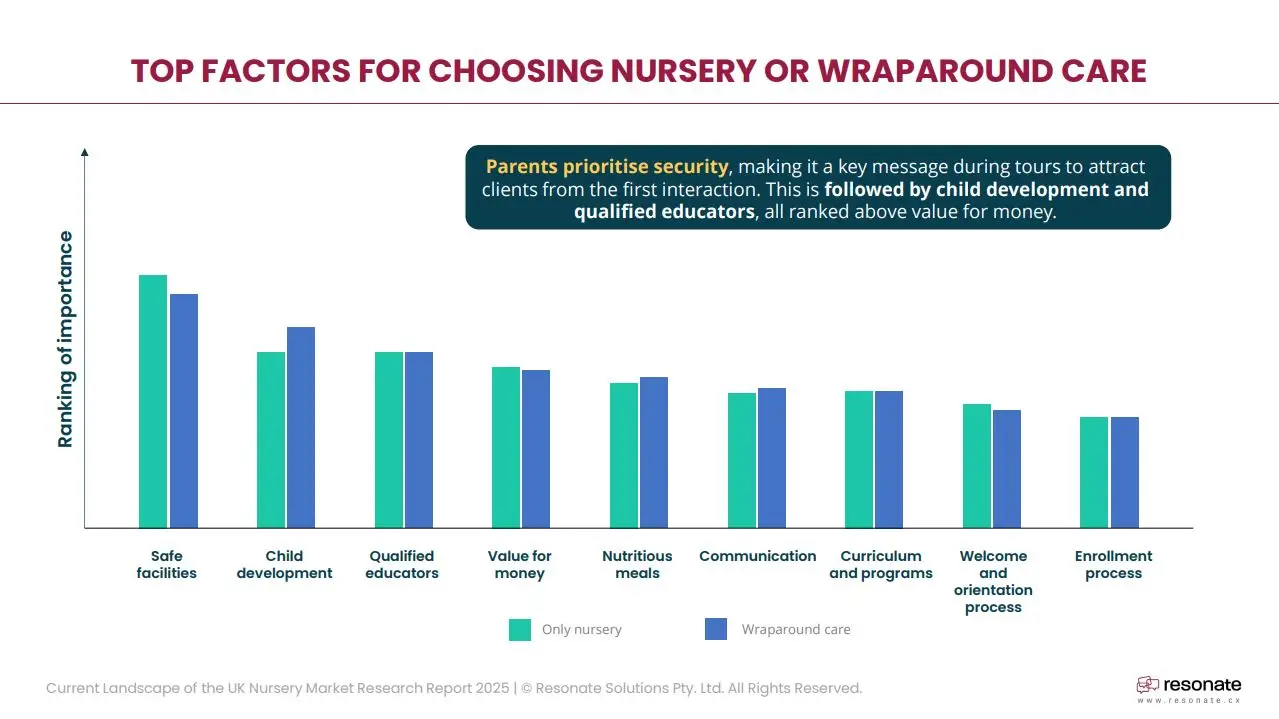

- Safety is the paramount factor influencing parents’ decisions for both nursery and wraparound care, encompassing physical facilities, engaged staff, and emotionally secure environments. Even minor details, such as shaded outdoor play areas and access to educational materials, contribute to a perception of a safe and nurturing setting.

Not too long ago, choosing a nursery or wraparound care felt straightforward. Parents needed a place they could trust. One that fit their schedules, supported development, and offered peace of mind. But today, that path feels more like a maze. Post-pandemic realities, hybrid work, rising costs, and evolving expectations have turned childcare decisions into one of the most complex and emotional choices modern families make.

Resonate CX’s Current Landscape of the UK Nursery: Market Research Report 2025 explores how families are making these decisions now and how providers can help guide them through the maze.

Nurseries Customer Opportunities 2025 | United Kingdom

Uncover what parents value most when choosing childcare providers.

How Usage Patterns Are Changing

One of the biggest shifts? Full-time childcare is no longer the default. With more parents working hybrid or remote schedules, many are opting for part-time care of just two or three days a week instead of the traditional five.

Back in 2024, 30% of families used childcare services full-time. Today, that number has dropped to just 22%. And it’s not just about convenience — it’s about financial pressure, family balance, and rethinking what “support” really looks like in 2025.

As parents juggle new work-life rhythms, childcare providers are being asked to flex with them. The old one-size-fits-all models? They no longer fit.

It’s true that the impact of COVID on in-person work is evident, directly affecting the demand for Nursery services. While the UK is returning to full-time office work slower than other countries, this shift is expected to accelerate over the next year.

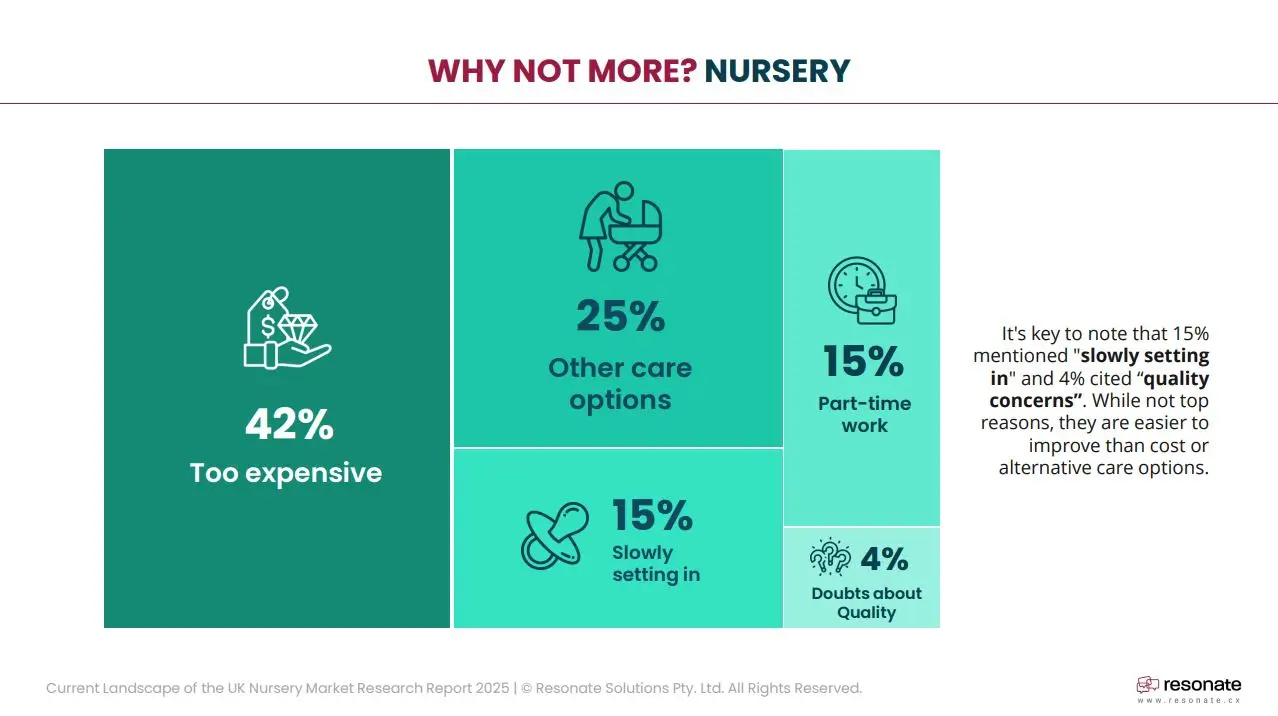

Even when the need is clear, not all families are signing up. Why?

Major obstacles for additional nursery use include the following:

- Too expensive – 42%

- Availability of other care options – 25%

- Part-time work reducing need – 15%

- Slow settling in – 15%

- Quality concerns – 4%

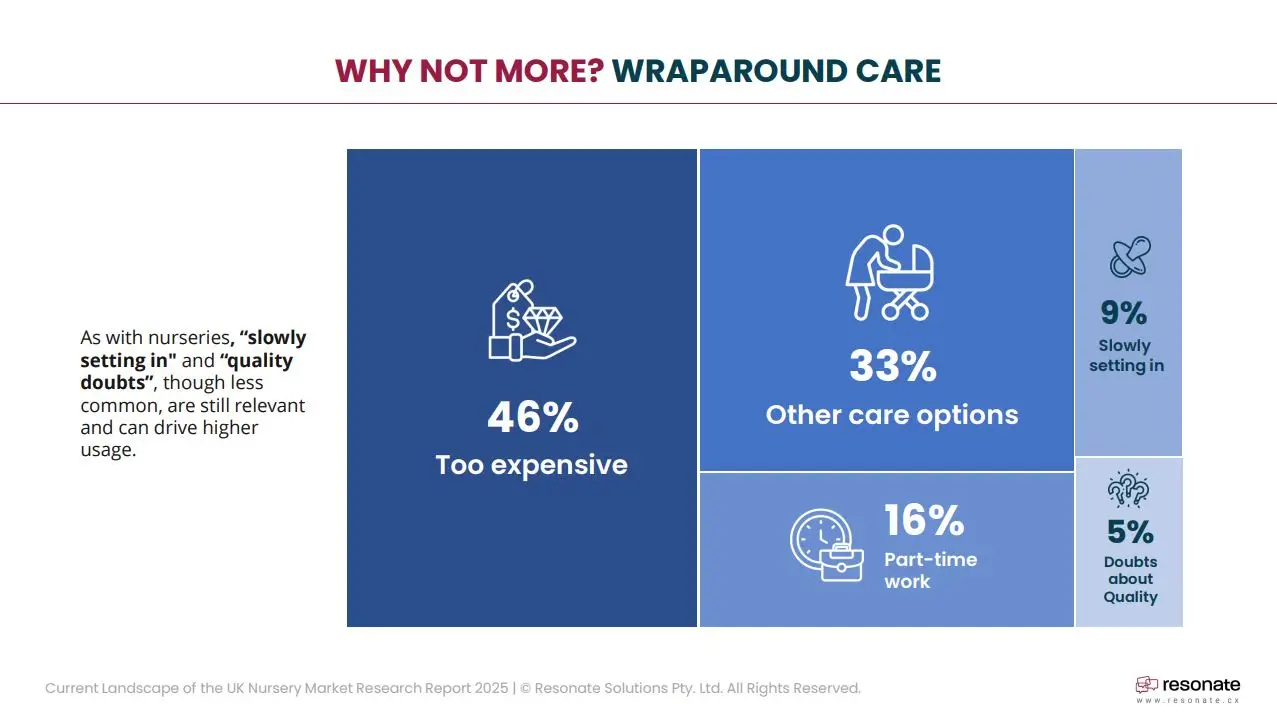

The obstacles for additional wraparound care use largely mirror those of nurseries:

- Too expensive – 46%

- Availability of other care options – 33%

- Part-time work – 16%

- Slow settling in – 9%

- Quality concerns – 5%

This means families aren’t just looking for availability. They’re measuring value. Is this worth the cost? Will my child feel safe? Will this genuinely support our lifestyle?

Different Services, Different Needs

It’s tempting to think all childcare decisions follow the same logic. But motivations vary, especially between nursery and wraparound care.

For nurseries, work commitments remain the top driver, but social interaction and early education rank nearly as high. Parents see these services as critical to their child’s development.

In wraparound care, the emphasis shifts. Yes, work remains a factor, but family routine and logistical ease often take centre stage. These programs are about making daily life work, not just learning outcomes.

Understanding this difference matters. It changes how providers position their services, speak to parents, and design experiences that align with real-life needs.

Top Decision Drivers When Choosing a Provider: What Matters Most

No matter the care type, one thing always sits at the top of the list: safety.

Safe facilities are the baseline. But parents are looking beyond locked gates and clean bathrooms. Instead, they want warm, engaged staff, spaces that inspire, and environments that feel secure emotionally as well as physically.

Small details matter: shaded outdoor spaces, book corners, musical instruments, craft materials. These signals that a centre understands how children thrive.

Why Do Parents Switch Providers? Key Reasons for Churn

Just as important as why families choose a provider is why they leave understanding key reasons for churn is also important – two sides of the same coin.

Families that used nurseries prioritised the following:

- Safety or facilities – 36%

- Location/accessibility – 28%

- Issues with staff – 26%

- Loss of job or financial problem – 23%

- Communication/support – 23%

- Curriculum – 23%

- Change family needs – 18%

Users of wraparound care services ranked these same priorities like so: (PDF p. 14)

- Change family needs – 50%

- Location/accessibility – 43%

- Issues with staff – 21%

- Curriculum – 21%

- Safety or facilities – 21%

- Loss of job or financial problem – 14%

- Communication/support – 14%

Addressing the specific factors that drive parents to leave should reduce churn and improve long-term retention. However, those factors aren’t uniform across nurseries and wraparound care services, because families use them for different reasons. This divergence underlines the importance of tailoring services and engagement strategies to better match each setting.

While not top decision drivers, touchpoints like orientation, enrollment, and curriculum clarity still influence decisions and should not be overlooked. Given that they are factors that can be directly controlled, childcare providers shouldn’t neglect these as potential areas for improvement.

Conclusion: Turning Insights Into Action

If the childcare journey feels like a maze, then providers have a choice: either add more turns… or become the guide that helps families find their way.

This is where customer experience management plays a crucial role. With the right tools and data, providers can uncover what matters most to families and design journeys that feel not just convenient, but intentional.

How can providers integrate these insights into their practices? These ideas may set providers in the right direction.

- During tours, providers must demonstrate safety measures, staff qualifications, and open communication with parents.

- Enrolment materials must also re-emphasise safety and staff quality while also clearly outlining developmental benefits.

- All communication must build up the trust that parents need to feel secure in their decision. Providers must, therefore, prioritise clarity, warmth, and responsiveness when communicating with parents.

As expectations from UK parents continue to shift, those who deliver on these key factors should stand out and stay ahead. However, doing so may require an even deeper understanding of evolving family preferences. Providers can use Resonate’s Education CXM Platform to uncover new insights and stay connected to what families value most.