Surveys are a vital tool in a successful Customer Experience (CX) strategy, enabling businesses to collect meaningful feedback directly from customers. The insights gained can help identify pain points, refine offerings, and enhance overall customer satisfaction. However, to drive real impact, a survey must capture precise and relevant information aligned with business objectives.

Effective survey design goes beyond simply listing questions—it requires a strategic approach that ensures every question serves a clear purpose and resonates with the target audience. To lay the groundwork for a successful survey, start with these fundamental steps:

Fundamental Steps in Making a Successful Survey

Step 1: Define Your Objectives for Collecting Customer Feedback

Every effective survey begins with a clear purpose. Ask yourself: What business issues are you trying to address? Are you, perhaps, aiming to improve customer retention, enhance product offerings, or identify service bottlenecks? Having a specific objective will guide the survey’s structure and content.

For example, if your goal is to increase customer loyalty, you might focus on questions that measure satisfaction with key touchpoints and identify areas for improvement. By aligning your survey with business goals, you can make sure that the data you collect is actionable and relevant.

Step 2: Include Decision Makers Across the Business in the Design Process

Each department in your organisation directly and indirectly impacts customer experience and satisfaction. Keeping this in mind, it’s imperative to involve representatives from all departments—not just those that are customer-facing—when designing surveys:

- Senior Executives: Understand overarching business goals and pain points, ensuring the survey aligns with strategic priorities.

- Customer Service & Support: Provide frontline insights into common customer frustrations, recurring issues, and service expectations.

- Marketing & Sales: Offer perspectives on customer motivations, buying behaviours, and brand perception.

- Product & Operations: Contribute knowledge on product/service usability, process efficiency, and operational roadblocks that impact experience.

- HR & Employee Experience Teams: Highlight internal factors, such as employee engagement and training, that influence customer interactions.

- IT & Data Teams: Ensure surveys are optimised for accessibility, integration, and data collection best practices.

Step 3: Understand How to Balance Quantitative and Qualitative Questions

A well-designed survey strikes the right balance between quantitative metrics and qualitative insights. While numbers reveal trends, open-ended responses provide the context needed to understand customer sentiment and drive meaningful action.

Quantitative Data for Precision:

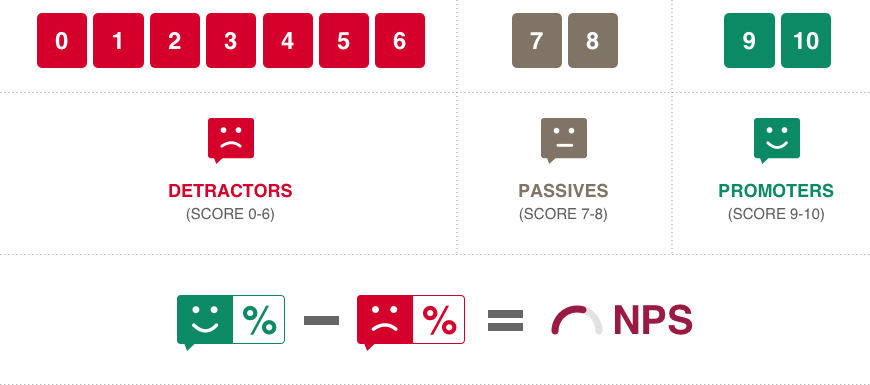

Metrics like Net Promoter Score® (NPS®), Customer Satisfaction (CSAT), and Customer Effort Score (CES) offer measurable benchmarks, helping businesses track overall sentiment shifts. However, these numbers alone only indicate what’s happening—not why customers feel a certain way or what should be done about it.

Qualitative Insights for Depth:

Open-ended responses and follow-up questions bridge the gap between data and decision-making by uncovering the reasons behind customer sentiment. For example:

- Promoters: Which features do you value or use the most?

- Passives: How can we improve your experience?

- Detractors: What was missing or disappointing in your experience with us?

Blending Both for Actionability:

The true power of combining qualitative and quantitative data lies in connecting structured scores with unstructured feedback. AI-powered text analytics, sentiment analysis, keyword extraction, and trend detection automate insight generation—ensuring businesses don’t just collect feedback but turn it into real-time, data-driven action.

By designing surveys with intelligence and strategic intent, organisations move beyond passive data collection. Instead, they proactively diagnose pain points, amplify strengths, and anticipate future customer behaviours.

Step 4: Be Aware of Survey Fatigue and Steer Clear of It

Beyond just length, survey fatigue is also about relevance, timing, and perceived value. Customers don’t ignore surveys because they’re busy; they ignore them because they don’t see what’s in it for them. It’s time to rethink how you earn and sustain respondent engagement.

- Shift from Length to Value: Instead of focusing solely on the number of questions, prioritise perceived effort vs. perceived value. Would a customer feel the survey respects their time while giving them a voice in shaping their experience? A 10-question survey that feels meaningful will outperform a 3-question survey that feels generic.

- Strategic Timing Matters: Instead of bombarding customers with requests, leverage event-triggered feedback—moments when the customer is most engaged and likely to provide thoughtful responses. Post-purchase, service resolution, or key milestones are prime opportunities. And surveys should give you different insights as well. For example, a returning customer should get a different survey than a first-time buyer.

How Can You Design a Survey Such That It Captures the Correct Information?

After you’ve established the purpose and direction of the inquiry, it’s time to come up with a survey that will allow your business to collect the information it needs. Here’s a list of tips that you can use to achieve this goal.

Measure Beyond the Numbers

Remember that NPS is just a number, and it would be hard to make a decision based on this number if it’s not properly contextualised. When collecting NPS, give customers options in the form of a line or a text box where they can offer candid statements and reactions. This way, they can elaborate on their responses and provide you with deeper context.

Keep Survey Questions Focused Using Optional Extras

Driver questions help pinpoint the factors influencing customer perceptions. For example, after a general satisfaction question, you might ask about specific drivers such as product quality, customer service, or pricing. For instance, a hotel might include questions like, “Was your room clean and comfortable?” or “How would you rate the responsiveness of the front desk staff” in their surveys. These specific queries allow you to identify strengths and areas for improvement in different aspects of the service.

While these questions are optional, they can provide valuable granularity for targeted improvements. Even if a respondent doesn’t complete the entire survey, capturing answers to a few key driver questions—like rating the quality of the breakfast or the efficiency of the check-in process—can still yield actionable insights.

Consider the Channels Used to Deliver the Survey

With mobile devices becoming even more integral to modern life and overtaking desktops as the preferred computing platform of global users, it’s essential to design surveys that are accessible across these platforms. A seamless mobile experience increases response rates and ensures feedback is gathered from a diverse audience.

Perfect the Survey by Testing and Refining Before Deployment

Survey design is an iterative process. Testing your survey before launch helps identify potential issues and ensures it meets your objectives. Consider these factors during the testing phase:

- Sample Size: Are you reaching a representative group of your customer base?

- Response Rates: What percentage of respondents are completing the survey?

- Completion Rates: Do respondents complete the survey, or do they drop off midway?

- Clarity: Are the questions easy to understand?

Gathering feedback from a small group of employees or trusted customers during the testing phase can reveal opportunities for improvement. For example, if respondents frequently skip a particular question, it may indicate that the wording is confusing or the question is irrelevant.

Designing a Survey Properly Is Just the Start

Designing a survey is only the first step in implementing an effective CX strategy. To maximise the impact of your customers’ responses, your organisation must not only collect feedback but also act on it in a structured and meaningful way. This is where closing the feedback loop becomes essential.

Closing the loop involves more than just analysing survey results—it requires a commitment to listening to customers, responding to concerns, and continuously improving their experience. A strong closed-loop feedback program typically follows four key lifecycle phases:

- Listen – Set up surveys to capture feedback from customers at key touchpoints or events.

- Act – Ensure frontline teams have access to the feedback and the ability to respond promptly to complaints or concerns.

- Discover – Regularly analyse survey data to uncover trends, pain points, and areas where the business excels.

- Improve – Use these insights to drive meaningful changes, whether by refining processes, enhancing products, or delivering better service experiences.

Implementing a structured process to review and act on customer feedback allows your business to not only address immediate concerns but also to track long-term trends and proactively refine strategies.

Designing a Survey That Captures the Right Information Is Both an Art and a Science

To collect data that can drive meaningful change, it’s a must for your business to define its objectives, get input from decision makers, balance quantitative and qualitative questions, and make an effort to avoid survey fatigue. With a well-designed survey and a commitment to acting on feedback, your business can build stronger relationships and deliver exceptional customer experiences.

To know more on how to run a successful customer feedback campaign, check out this eBook: Guide to Launching Your CX Program.

TLDR:

- Effective survey design starts with clear objectives, ensuring that each question directly contributes to gathering specific, actionable insights. This focus on purpose helps avoid irrelevant data and maximizes the survey’s value.

- Careful consideration of question types, wording, and structure is essential for accurate responses. Utilizing a mix of open-ended and closed-ended questions, and avoiding leading or biased language, can enhance data quality.

- A well-structured survey prioritizes the respondent’s experience, with a logical flow and manageable length. This approach encourages higher completion rates and yields more reliable information for analysis.