Times are changing for brick-and-mortar retailers. Customer purchase and online shopping are booming, but churn can cause shoppers to abandon your store. So how can you generate more revenue for your in-store channel? Targeting impulse buyers can help you get more value from your existing customers. And luckily, many of them are just waiting for the right conditions to let their impulses drive their shopping behavior.

What are the impulse purchasing trends of today’s shoppers?

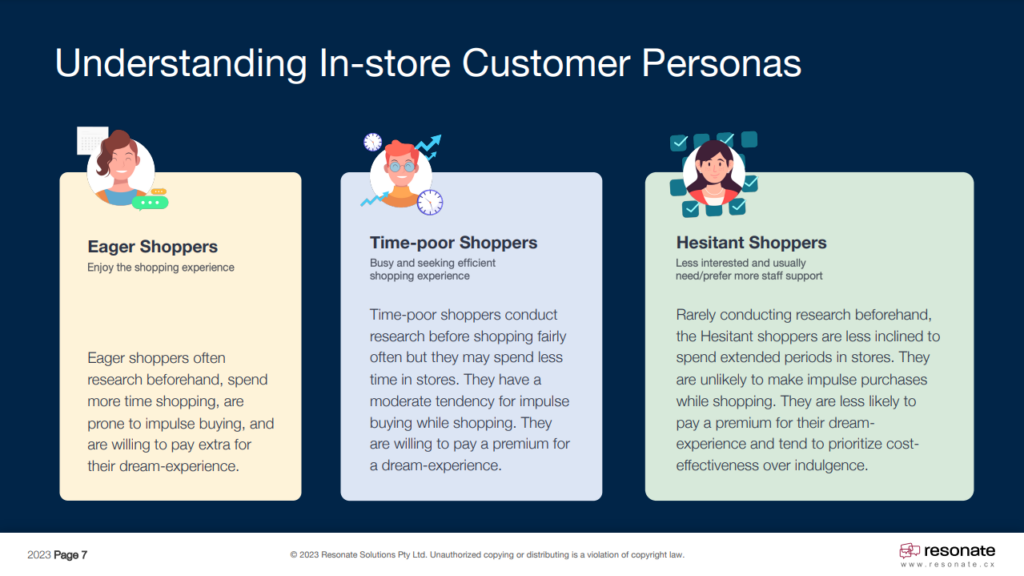

As we all know, not all shoppers behave the same way. So to understand impulse buying behaviors in shoppers, it’s first helpful to define the major cohorts of customers that could be frequenting your business.

Resonate’s latest market research report, The State of Brick-and-Mortar Retail Customers in 2023, looks at age, marital status, children, employment, and income level to outline three main groups of customers. These groups define three key personas, which Resonate has called Eager Shoppers, Time-Poor Shoppers, and Hesitant Shoppers.

- Eager Shoppers are generally young (aged 18–34) and single with no kids. They are employed and have relatively high levels of income, or at least have relatively fewer financial commitments. Therefore, this cohort has the most time and a lot of money to spend.

- Time-Poor Shoppers are middle-aged (35-54). While they are still employed and have relatively high income levels, they are generally married or partnered and have kids. This makes them a group of shoppers with a lot of money but not much time to spend.

- Hesitant Shoppers are the oldest cohort, aged 55 or more. They are generally married and have kids; however, they have much lower levels of employment and therefore have correlating mid-range income levels. These shoppers have time commitments and, more importantly, financial constraints, which cause them to be hesitant with their purchases.

Eager shoppers are much more likely to make impulse purchases, with an inspiring 83% of them saying they make impulse buys at least sometimes. For the Time-Poor Shoppers, this number is still impressively high at 72%. While only 43% of Hesitant Shoppers say they make impulse purchases, this number is still high enough to be more than significant. It’s clear that while impulse buying occurs at all age levels, it can be easier to encourage younger shoppers. This can be driven by their greater overall impulsivity and also by higher income levels in younger working cohorts.

What else inspires impulse buying? Most shoppers reported that exciting and appealing product displays were the number one trigger for making an impulse purchase. This is the biggest factor across all shopper personas. Therefore, should be a key consideration for encouraging impulse buying, but not the only one.

What does this mean for your business?

Retail customers are doing their own research

Impulse customer purchase can be a major boost to your in-store channel’s revenue. Currently, shoppers view visiting a brick-and-mortar store as an activity that can use up precious time, especially in comparison to online shopping. In order to prevent wasting time, a majority of shoppers do at least some online research before committing to going into a physical store. Time-Poor Shoppers are especially protective of their time, with nearly half of them, 47% of 35-44 year-olds and 49% of 45-54 year-olds, doing exhaustive research online before heading to a physical store. This number is still high for over 54-year-olds, with 42% of Hesitant Shoppers doing exhaustive research. In contrast, only 31% of 18-24 year-olds do this much research.

These findings show that older shoppers are wary of wasting time by going to brick-and-mortar stores, while younger shoppers are less averse.

Does doing research correlate with impulse buying behavior?

An impulse purchase can be defined as a customer purchasing something in a store, they had not planned on buying. So should we expect that the more research a customer does prior to entering a store, the more that customer’s purchases will be limited to planned and researched items?

It turns out that the numbers don’t line up precisely. Young Eager Shoppers do the least research before heading to the shops, and they show the most impulsive behavior. Middle-aged Time-Poor Shoppers do the most research yet still have moderate-to-high levels of impulse buying. Older Hesistant Shoppers who do a moderate amount of research have the least impulsive behavior. This is likely due to their more limited income and lower levels of employment. In short, impulse buying behavior has the greatest correlation with income and employment.

Even though the levels of impulsivity vary across these cohorts, there is still a lot of opportunity for increasing store revenue by encouraging impulse customer purchase.

What drives impulse buying?

According to Resonate’s market research, the driving factors that encourage impulse purchases generally follow a similar pattern for all three shopping personas, with younger shoppers being more attracted to impulse triggers than older shoppers.

Appealing promotional displays

All three groups highlighted exciting or appealing promotional displays as the single greatest cause of their impulse purchases. These displays attract 56% of young, 53% of middle-aged, and 46% of older shoppers. They represent by far the biggest reason respondents gave for their impulse buying.

Exciting or appealing displays can focus attention on products by appealing to special deals that offer opportunities for great value. Urgency can be a strong driver, with limited-time offers from the retailer influencing customers’ fear of missing out. New types of products can create a sense of novelty, offering customers new experiences that especially appeal to younger shoppers.

Product bundling

Product bundling encourages 30% of young shoppers, 20% of middle-aged shoppers, and 19% of older shoppers. Selling products together motivates them to buy more. This is the second-strongest driver for young shoppers but is not so for the other groups. Therefore, this suggests that bundling new products with established ones offers a sense of novelty, which especially attracts this cohort.

Exciting product placement

For the middle-aged Time-Poor Shoppers, the second biggest influence is exciting product placement and is the only factor where this group scores higher (32%) than the younger cohort (30%). This is likely because these time-strapped customers spend less time in the store, but strategic placement still enables them to see products while speeding through their shopping. Conversely, only 13% of older shoppers respond to product placement, indicating a possible “blindness” to this strategy.

Experiencing products

Many retailers will find it unsurprising that the second biggest influence on the impulse buying behavior of older Hesitant Shoppers is experiencing products. The older shoppers score higher at 26% than both other cohorts (younger 24% and middle-aged 23%) for this factor. This makes a lot of sense because this is classic shopping behavior that most of this cohort grew up with. While the younger groups have become accustomed to online shopping, older shoppers are more reassured about their purchases. Because they have the ability to try on and test out products. If this is your store’s target cohort, encouraging product experience (fitting rooms, tester products, etc.) can encourage more impulsivity in older customers.

Staff recommendations

The final factor given is receiving product recommendations from the store’s staff. This factor had the lowest influence score for all cohorts (17%, 16%, and 11%, youngest to oldest), likely reflecting increased research in all groups and a correlated resistance to the influence of sales staff.

Encouraging impulse buys can be a big boost to revenue

Encouraging impulse customer purchase can greatly increase revenue for your store. Your efforts can vary based on the target cohorts that frequent your store. Since younger, more affluent shoppers respond to different influences than older, hesitant shoppers. But there’s still a lot more to the story, so don’t hesitate to download Resonate’s State of Brick-and-Mortar Retail Customers in 2023 report for more insightful statistics on what keeps customers coming back to your store.