TLDR:

- Physical retail continues to thrive despite the digital shift, with a majority of UK consumers still shopping in-store weekly. This is largely due to the unique advantages physical stores offer, such as instant gratification and the ability to experience products firsthand.

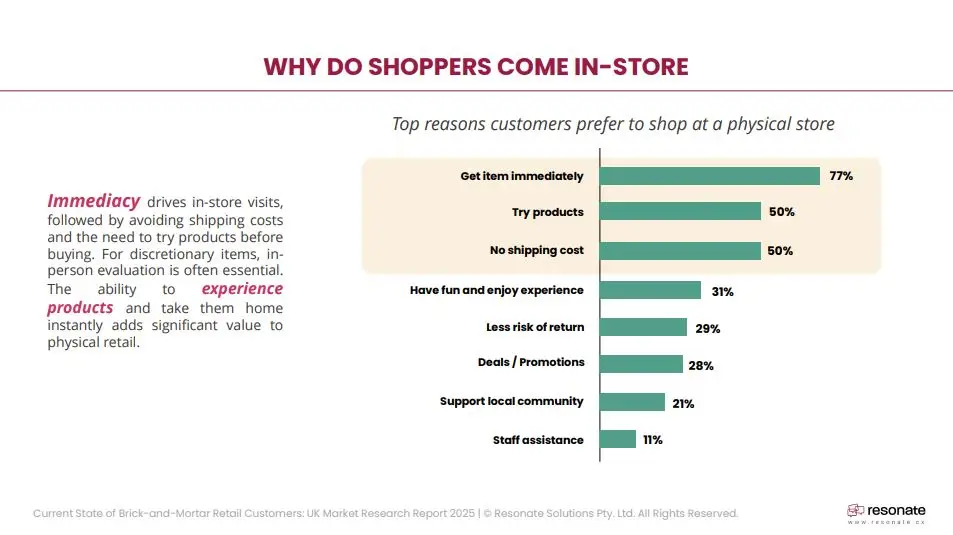

- Shoppers choose brick-and-mortar stores for immediate satisfaction, the opportunity to try products before buying, and to avoid shipping costs. The experience of shopping in-store also provides an element of fun and enjoyment that online retail often lacks.

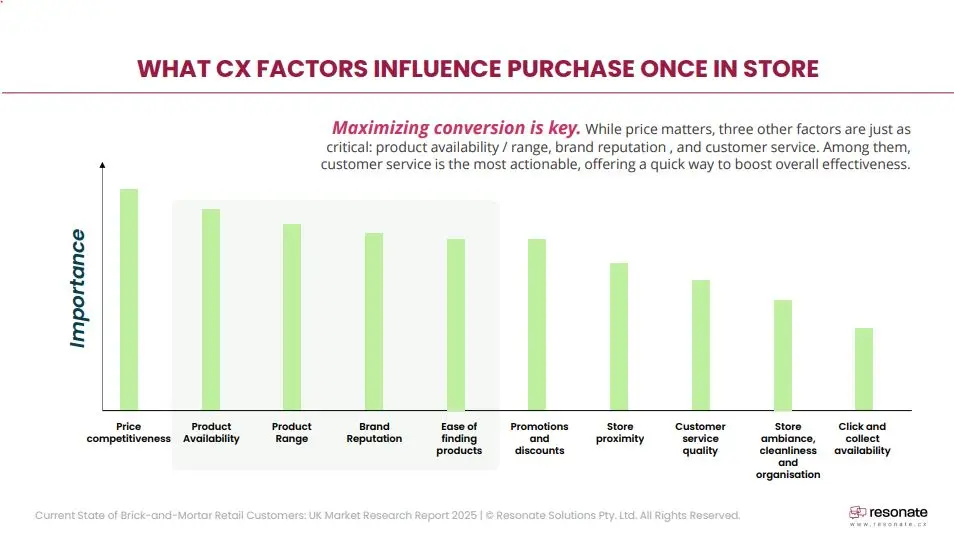

- Key customer experience factors influencing in-store purchase decisions include competitive pricing, product availability, ease of finding items, helpful staff, and the overall store layout and cleanliness. These elements are crucial for encouraging shoppers to complete their purchases.

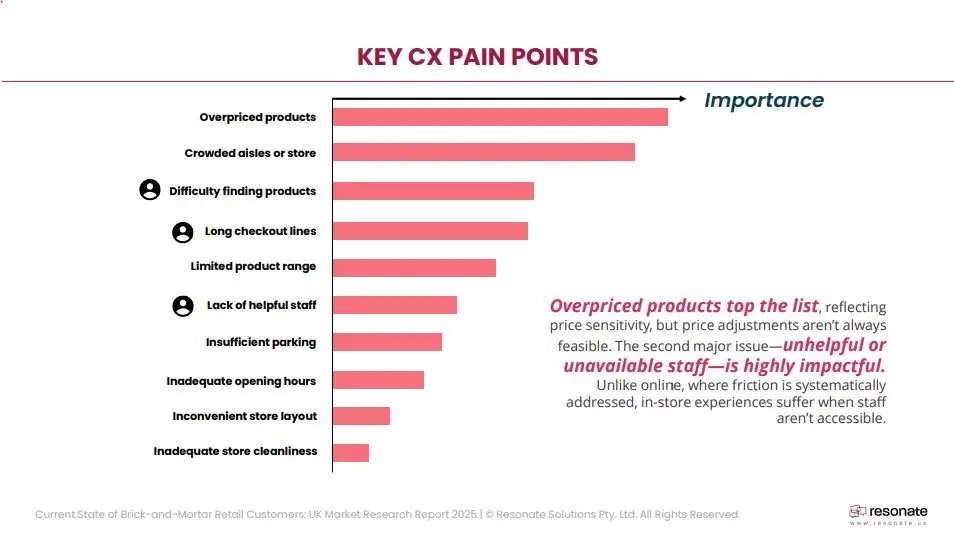

- Common pain points that erode the in-store experience include overpriced products, crowded aisles, difficulty locating items, and long checkout lines. Addressing these frustrations, even through simple adjustments, can significantly improve customer satisfaction.

- Impulse purchases are very common in physical stores, often triggered by promotions, convenience, and emotional responses. Retailers have a strong opportunity to increase sales by strategically using product displays and providing excellent service to encourage unplanned buys.

- The goal for retailers is to create an in-store experience that is easy, fast, enjoyable, and personalized, encouraging shoppers to naturally spend more. Prioritizing CX improvements related to product accessibility, queue management, layout, and staff training can lead to increased basket sizes and long-term customer loyalty.

It’s a crisp Saturday morning in London. Everyone’s on their phones, laptops, and devices. The high street is buzzing, cafés are full, and shopfronts are gleaming with new-season stock. Despite the rise of online shopping, millions of Brits are choosing to walk into physical stores not just to browse, but to buy. And often, to buy more than they planned.

So why are they still showing up?

As it turns out, the answer isn’t just about what’s on the shelf. It’s about the entire experience wrapped around it. And that experience is shaping not just how much customers buy but whether they come back at all.

Our latest market insights report called Retail Customer Opportunities: Market Research Report 2025 I United Kingdom uncovers some surprising statistics and key CX drivers, pain points, churn factors, and other areas that shape in-store behaviour. It also uncovers what pushes retail customers towards competitors and provides insights for increasing purchases per visit.

Current State of Retail Customers 2025 | United Kingdom

Uncover the key customer mindsets to reduce churn and increase basket sizes.

The Current State of In-Store Shopping: Why Physical Retail Still Thrives

In a world that’s gone digital, one might assume the high street is hanging by a thread. But reality tells a different story.

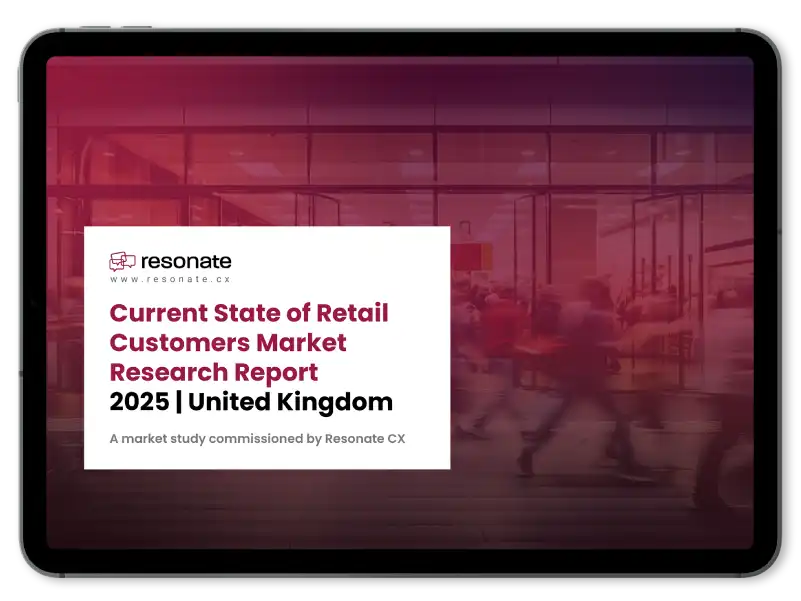

Our study revealed that 62% of UK consumers still shop in-store weekly, with 12% going daily, numbers that outpace online shopping in frequency.

Whether it’s grabbing a last-minute gift, trying on the perfect pair of sundress, or simply enjoying the pleasure of browsing, in-store shopping satisfies something online carts can’t quite capture:

- Instant gratification – Customers can bring purchases home immediately, which is ideal for urgent or spontaneous needs (e.g., a last-minute birthday present or a new outfit for an event).

- Hands-on experience – Shoppers can see, touch, and try products in person, which builds confidence in quality and fit (e.g., trying on shoes or testing a phone’s user experience).

- More confidence – The ability to physically interact with products makes the shopping experience feel less risky and more enjoyable.

- Physical experiences are hard to replicate online – Even with virtual and augmented reality technologies, digital retail still struggles to match the immediacy and connection that in-store shopping provides.

Why Shoppers Choose to Visit Brick-and-Mortar Stores

Here are the top 5 reasons customers continue to prefer brick-and-mortar shops:

- Get item immediately – 77%

- Try products – 50%

- No shipping cost – 50%

- Have fun and enjoy the experience – 31%

- Less risk of return – 29%

Though practical concerns predominated, they don’t tell the whole story. Notably, about 31% say they shop in-store for fun and enjoyment, highlighting the emotional element of shopping, which retailers may use to their advantage when increasing loyalty and basket sizes.

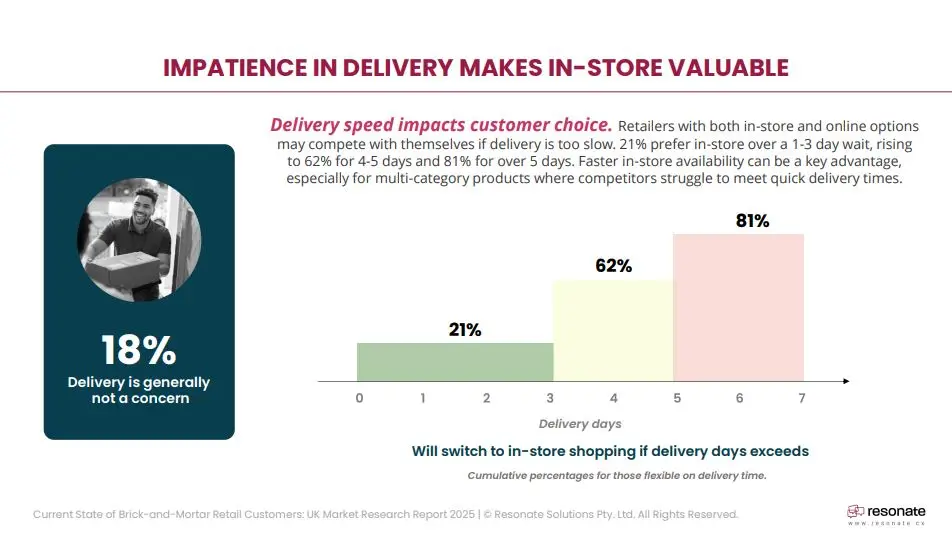

The Delivery Factor: How Waiting Time Pushes Customers Back Into Stores

When online deliveries drag on, in-store footfall rises. The study data reveals that 62% of shoppers will abandon online orders if delivery takes more than 4–5 days, and 81% will do so beyond that. Even a 1–3 day delay causes 21% to switch to in-store shopping. This further reinforces the finding that immediacy is the key driver of in-store visits.

For retailers that offer both online and offline channels, slow fulfilment times can inadvertently push customers into their stores. This means that every physical location must be equipped to convert that footfall into sales and, if possible, larger basket sizes.

The Core CX Factors That Influence Purchase Decisions In-Store

Here’s where the chase heats up.

While 98% of shoppers admit to making impulse buys in-store, only 2% say they never do. That’s a huge window of opportunity! But capturing it requires more than clever end-cap displays.

What actually nudges a shopper from “just looking” to “add to basket”? The top 5 triggers are crystal clear:

- Price competitiveness

- Product availability

- Ease of finding items

- Helpful staff

- Store layout and cleanliness

Common Pain Points That Erode the In-Store Experience

Shoppers won’t hesitate to walk away with nothing if the experience is frustrating. However, unlike with online stores, in-store pain points can be eased when staff is accessible, giving traditional retail yet another key advantage. Here are the in-store CX pain points, ranked from most to least important:

- Overpriced products

- Crowded aisles

- Difficulty finding products

- Long checkout lines

- Limited product range

- Lack of helpful staff

- Insufficient parking

- Inadequate opening hours

- Inconvenient store layout

- Inadequate store cleanliness

While price adjustments may not always be feasible, layout tweaks, clearer signage, and empowered store staff can resolve many of the other frustrations. While the lack of helpful staff in itself was not a particularly high pain point, more capable staff can help with other highly-rated concerns like finding products or speeding up checkouts.

The Churn Triggers: What Makes Shoppers Switch to Competitors?

Now that we know the pain points that erode their experience, what makes them want to switch?

Imagine your customer walks in looking for a jacket they saw online. They can’t find it. No staff are nearby. The aisle is cluttered. And the queue at checkout snakes into the next aisle.

They leave empty-handed and frustrated.

That jacket was probably bought later that night from a competitor’s site.

According to our data, 62% of shoppers will switch stores if they feel prices are too high, and 52% if the product range feels limited. Even long queues and crowded layouts push them away.

But the good thing is some of the biggest irritations (like product placement or signage) are entirely within a retailer’s control.

Retailers should prioritise improvements that directly address top churn triggers. Even then, some fixes are easier and more impactful than others. For instance, increasing staff availability is often easier than changing prices, but it can also ease multiple other issues like long lines, inadequate assistance, and difficulty finding products. Small, targeted changes can havean outsized impact when aligned with what matters most to customers.

Pre-Shopping Research: Information That Shapes In-Store Visits

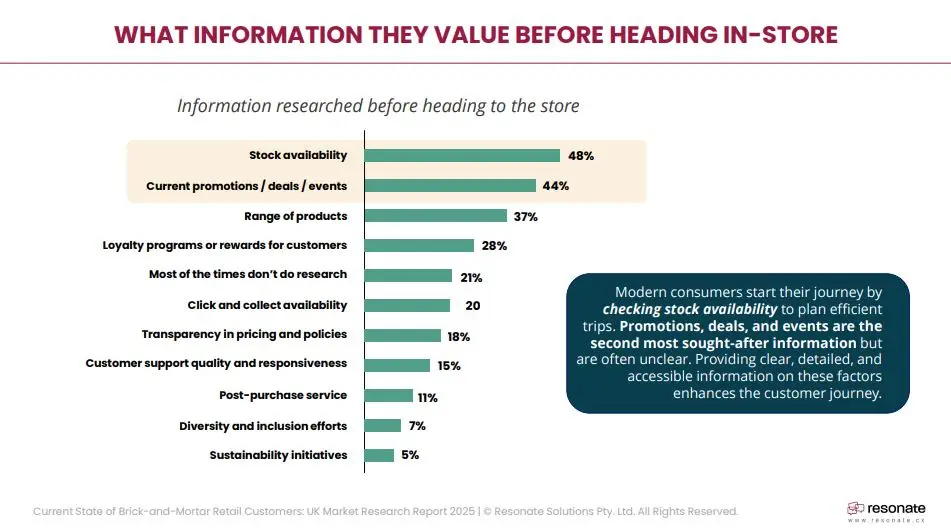

Let’s move on to what they look for before stepping into your store. Today’s shoppers need to be informed before they even step inside. Here is the information that customers mentioned they researched:

- Stock availability – 48%

- Current promotions/deals/events – 44%

- Range of products – 37%

- Loyalty programmes or rewards for customers – 28%

- Most of the times don’t do research – 21%

- Click-and-collect availability – 20%

- Transparency in pricing and policies – 18%

- Customer support quality and responsiveness – 15%

- Post-purchase service – 11%

- Diversity and inclusion efforts – 7%

- Sustainability initiatives – 5%

As one can see, almost half of modern in-store consumers check for stock availability to make shopping trips more efficient. Promotions, deals, and events are almost as important. Making these and other key pieces of pre-visit information accessible to customers improves CX, encouraging them to make trips to physical stores where retailers can further enhance their experience.

Where Customers Expect More Service: Smart Staff Allocation for Better CX

Now you know what they’re researching for. Everything’s going smoothly. They’re in line to check out. Perfect! By the time a customer reaches the checkout, the hard part should be done… right?

Not quite.

58% of shoppers say checkout is the #1 area where they want more service. It’s not about a friendly smile alone. It’s about speed, clarity, and making sure nothing derails the sale at the last second.

Other critical moments where service matters? Returns, product advice, and fitting rooms. These are the turning points where a good experience becomes a great one or where a sale quietly slips away.

Unlocking Impulse Buys: What Drives Unplanned Purchases In-Store?

Impulse buying remains a significant opportunity for basket growth, with only 2% of in-store shoppers reporting that they never make unplanned purchases, leaving a whopping 98% of shoppers who make impulse buys. About 51% of shoppers report making unplanned purchases “sometimes”, 23% say they did so “most of the time”, 15% mention they made impulse buys “rarely”, and 9% say they “always” made unplanned purchases.

While impulse purchases are common in physical stores, shoppers report different triggers. Here are the factors influencing impulse purchases among UK customers:

- Current promotions/deals/events – 58%

- Convenience/ease of purchase – 38%

- Personal emotions/mood – 34%

- Product display, packaging, and branding – 25%

- Previous positive brand experiences – 22%

- Emotional appeal or desire for gratification – 21%

Retailers have a great opportunity to increase margins by allocating resources in areas that directly stimulate impulse buys. In particular, focusing on good service can help better leverage the triggers that matter the most to customers.

Conclusion: Turning CX Insights into Action for Bigger Baskets

This isn’t just about selling more. It’s about designing an experience that invites shoppers to spend more without pushing them to.

When physical retail gets it right, it becomes more than a sales channel. It becomes a space where loyalty is built, brand value is felt, and unplanned purchases flow naturally. The winning formula is simple:

- Make it easy.

- Make it fast.

- Make it enjoyable.

- Make it personal.

To gain the best outcomes, retailers must focus on CX improvements that directly grow basket size and loyalty. That means removing friction where it counts by fixing product accessibility issues, better managing long queues, optimising store layouts, and training staff to better meet customer needs.

Retailers must also start anticipating customer needs in real time by offering information on stock availability and deals, preferably before customers arrive at the store. Once customers are at the store, adequate checkout support must also be provided to help them complete their purchases.

With these relatively simple steps, retailers can create meaningful experiences that encourage more purchases as well as long-term loyalty.

Want to stay ahead of shifting retail trends? Download the full UK Market Research 2025 report to access all the insights.