TLDR:

- The retail landscape is evolving, with customers expecting a blend of technology and personal interaction. Retailers must understand individual preferences for speed and convenience versus human assistance to create optimal in-store experiences.

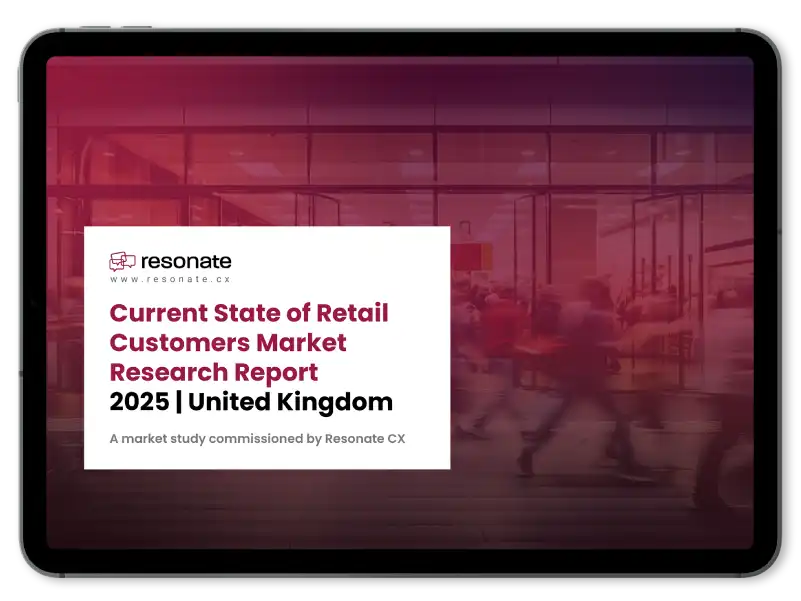

- The report categorizes UK retail customers into three distinct mindsets: Traditional, Aspiring NEO, and NEO, based on the NEO consumer typology. These classifications are crucial for understanding varied customer behaviors and preferences.

- “Traditional” shoppers, making up 45% of respondents, are often price-sensitive and prefer staff assistance. This group typically consists of individuals over 55 with mid-level incomes and education, valuing routine in their shopping.

- “Aspiring NEO” customers, 35% of respondents, represent a hybrid group. They appreciate both innovation and personalized service while remaining budget-conscious, making them a diverse segment across all age ranges.

- “NEO” customers, 20% of the surveyed population, are high-value shoppers who prioritize innovation, premium experiences, and exceptional customer service. They are often early adopters of technology and tend to make more unplanned purchases.

- Service preferences vary greatly by persona; for instance, only 16% of Traditional shoppers strongly prefer self-service, whereas 20% of NEOs do, with an additional 52% of NEOs somewhat preferring self-service. This highlights a clear inclination towards autonomy among NEOs.

- Retailers need to strike a balance between providing self-service options and maintaining adequate human support. Failing to adapt to these evolving preferences could lead to a loss of relevance, especially with forward-thinking customers who value independence.

Walk into any modern retail store and you’ll notice it.

A self-checkout beeps steadily like a metronome.

A sales assistant chats warmly with a regular.

A shopper taps on a touchscreen, comparing colours and stock.

Welcome to retail’s new reality: a blend of technology and human touch.

Today’s retail environment is shaped by one key principle: shoppers expect you to meet them where they are. Knowing what your customers want, be it speed and convenience or familiar, face-to-face interaction, is critical to creating the right in-store experience.

Our team at Resonate CX, a leading provider of customer experience management platforms trusted by global retailers, offers insights that can help your business explore how different shopper mindsets influence service preferences.

Our market study, The Current State of Retail Customers: UK Market Research Report 2025, provides retailers based in the UK with an overview of the different types of shopper mindsets and how these can impact where they bring their business. The NEO consumer typology, which served as a basis for the report, was created by and is the property of Dr. Ross Honeywill. Let’s take a closer look at who your customers are and how they want to engage in-store.

Current State of Retail Customers 2025 | United Kingdom

Uncover the key customer mindsets to reduce churn and increase basket sizes.

Meet Your Shoppers: The Three Key Customer Personas in UK Retail

According to Resonate CX’s latest UK retail market study, today’s customers fall into three distinct mindsets:

Traditional (45%)

Traditionals are often price-sensitive and value routine. They prefer familiar service styles and typically favour staff-assisted service. This group has a broad age appeal, slightly skewing towards those over 55, with mid-level incomes and education levels around secondary school or vocational training. They are commonly found in metropolitan and suburban areas.

In a nutshell: They value familiarity, routine, and a human touch.

Aspiring NEO (35%)

Aspiring NEOs make up 35% of the respondents, and they blend characteristics of both Traditionals and NEOs. They appreciate innovation and personalised service but remain conscious of pricing. While they have lower spending capacity, they aspire to the NEO lifestyle. This group is prevalent across all age ranges, with a slight emphasis on the 18-24 bracket, and possesses mid to high incomes with similar educational backgrounds to Traditionals. They also reside in metropolitan and suburban regions.

In a nutshell: They admire innovation but still seek out deals. They’re flexible, comfortable with kiosks, but appreciative of help when it matters. Their tone is transitional.

NEO (20%)

The last 20% of the respondents are NEOs. These are high-value customers with disposable income who prioritise innovation, premium experiences, and excellent customer service. They are willing to embrace new technologies and often make unplanned purchases. This group shows a strong presence across all age ranges, slightly favouring the younger 18-24 bracket, with high incomes and university or postgraduate education. They are predominantly located in metropolitan areas.

In a nutshell: They crave speed, autonomy, and sleek self-service. They value frictionless convenience. Play this section too softly, and they’ll walk out.

Mindsets That Shape the In-Store Experience

How customers think is just as important as what they buy. A shopper’s mindset, whether they’re driven by experience, value, innovation, or routine, shapes how they interact with every element of your store. These mindsets influence what kind of service they expect, how much time they’re willing to spend, and what makes them return or churn. Take a look at the priorities of different shopper mindsets:

- Experience vs. Discounts

NEOs seek premium experiences and are less price-sensitive, whereas Traditionals focus on obtaining the best deals. - Brand Values vs. Economic Options

NEOs are attracted to brands that demonstrate authenticity and sustainability, while Traditionals prioritise reliability and value. - Preference for Self-Service vs. Staff Interaction

NEOs favour self-service options that offer control and efficiency, whereas Traditionals prefer human interaction for assistance.

Self-Service or Staff? The Divide in Customer Expectations

Service preferences aren’t one-size-fits-all. They shift by shopper mindset. While Traditional shoppers still lean on staff interaction, NEOs are far more comfortable navigating on their own.

In fact, only 16% of Traditional shoppers strongly prefer self-service, compared to 20% of NEOs. But the real difference lies in the middle ground: over half of NEOs (52%) somewhat prefer self-service, showing a clear trend toward autonomy.

What this means for retailers is tailoring the balance between self-service options and human support is expected. Getting it wrong could mean losing relevance with your more future-facing customers.

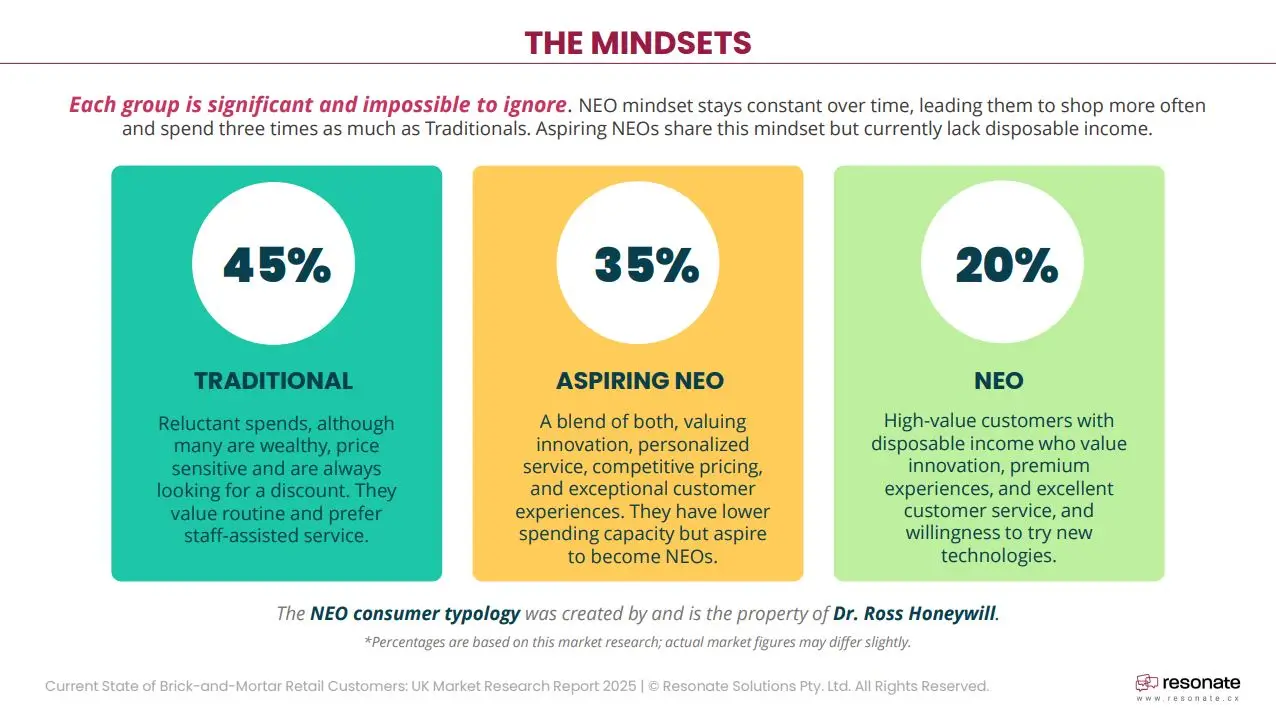

Driving Impulse Buys: The Role of Staff vs. Self-Service in Unplanned Purchases

Unplanned purchases are an important revenue driver, and understanding what influences this activity can help you boost basket sizes. Different personas respond to different cues, from promotions to store layout and the presence (or absence) of helpful staff.

- NEOs

They respond well to convenience and appealing product presentations. This makes self-service kiosks and interactive displays effective for targeting consumers with this mindset. - Traditionals

They are more driven by deals and promotions. To attract their attention, staff members can highlight current offers and provide personalised recommendations.

Promotions, convenience, and emotions are top motivators for impulse buying. While 58% of shoppers say deals influence them, 38% cite ease of purchase, and 34% say mood plays a role. Retailers that can seamlessly blend technology and human assistance here will create more opportunities to boost sales.

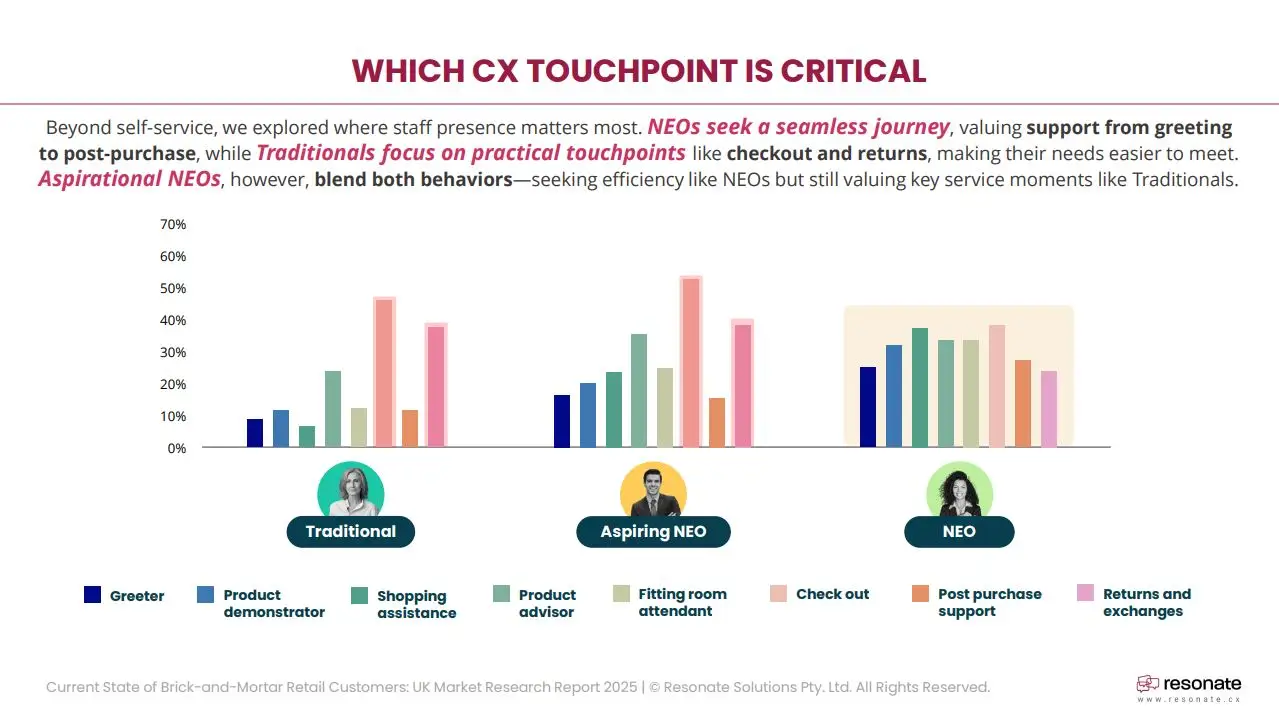

Where Human Touch Still Matters: Priority Service Touchpoints by Persona

Technology may reshape retail, but human interaction continues to play a crucial role in retail, especially at specific touchpoints in the customer journey. Understanding where each persona expects staff involvement helps you deploy team members where they make the most difference.

- NEOs

They appreciate support throughout the shopping journey but prefer seamless, efficient processes. Staff presence from greeting to post-purchase adds to a sense of care and premium service to their shopping experiences. - Traditionals

They prioritise practical touchpoints such as checkout and returns, and they value clear and helpful assistance during these stages. - Aspiring NEOs

They seek a blend of efficiency and key service moments and appreciate both self-service options and staff assistance during critical interactions.

Pain Points and Churn Drivers: What Frustrates Each Persona the Most While Shopping In-store?

To retain your customers, you need to understand what’s most likely to push them away. Different personas are sensitive to different pain points, and service breakdowns in these areas often lead directly to churn. Among the standout factors for churn are:

- Overpriced Products and Limited Product Range

This is a primary concern for Traditionals, though price adjustments may not always be feasible for retailers. - Insufficient Parking and Long Checkout Lines

NEOs are particularly affected by this, and failing to meet their expectations for more options can lead to churn.

By prioritising improvements in product range, pricing transparency, store layout, and access, you can better meet the expectations of each persona. Tackling these concerns head-on helps prevent dissatisfaction from turning into lost business.

The Balancing Act: Designing CX That Appeals to Every Persona

At its heart, creating a strong in-store experience isn’t about choosing self-service over staff, or vice versa. It’s about mastering the blend. Understanding when speed matters, when empathy matters, and when customers need both.

Retailers that get this balance right are already seeing the results: higher satisfaction, more frequent unplanned purchases, and stronger brand connections. On the other hand, those who treat customer experience as a one-size-fits-all solution are losing relevance with shoppers who expect more nuance.

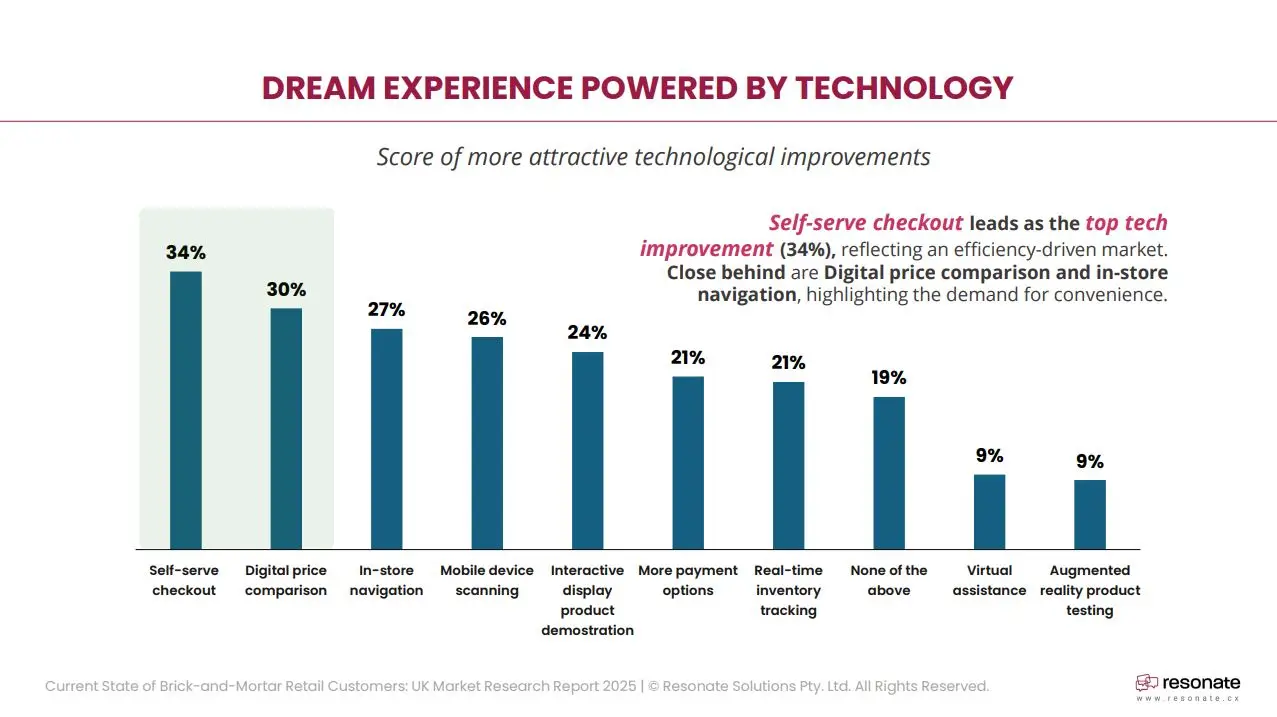

To cater to the diverse preferences of each persona, consider the following strategies:

- Offer Flexible Checkout Options

Provide both self-service kiosks for NEOs and staffed checkouts for Traditionals. - Empower Staff as Product Advisors

Train staff to offer insightful advice and cater to those who seek human interaction. - Implement Interactive Displays

Utilise technology to engage tech-savvy shoppers while maintaining staff availability for assistance. - Communicate Promotions Clearly

Ensure deals and offers are prominently displayed and staff are informed to share this information with interested customers.

By planning service around mindset and not just demographics, you’ll meet shoppers on their terms and build stronger connections.

Meeting Shoppers Where They Are

The future of retail isn’t automated. And it isn’t entirely human either. It’s hybrid.

To create a store that works for everyone, from the deal-seeking Traditional to the tech-forward NEO, you need to match mindset to service model. Let customers lead their own journey, with the safety net of staff when needed.

Because in the end, the best kind of service is the one that feels invisible but always shows up when it counts.Regularly gathering and analysing customer feedback, plus the use of an AI-assisted retail CXM platform, will further enable you to adapt and refine your strategies and ensure that your retail environment remains responsive to evolving consumer expectations. For more information, download Resonate CX’s market study and see how your retail business can cater to the needs of shoppers with different mindsets.